Fundrise Assessment 2024: Execs, Cons and How It Compares

DollarBreak is reader-supported, when you sign up through links on this post, we may receive compensation. Disclosure.

The content is for informational purposes only. Conduct your own research and seek advice of a licensed financial advisor. Terms.

We test different ways to make money online weekly and provide real-user reviews so you can decide whether each platform is right for you to earn side money. So far, we have reviewed 600+ platforms and websites. Methodology.

Fundrise is a crowdfunded real estate investment platform that enables members to pool their financial resources together to invest in property. The platform operates on a value-investing principle, and cureently had over 200 assets worth over $5.1 billion on behalf of its investors. If you want to start investing in real estate without the high cost, then Fundrise is the platform for you.

Pros

- Low minimum starting investment – you can start building your investment portfolio from just $10. You can increase your investments over time.

- High historical returns – investments with the platform have traditionally performed relatively well, with high annual returns of up to 12.4%.

- Low invesment fees of 1% . You can get a fee waiver by referring friends.

- Diverse investment portfolios – Fundrise invests in over 16 different REITs and funds, reducing volatility and market exposure, increasing returns.

Cons

- Investments are not very liquid – Fundrise investments are meant to be long term (5 years or more) and you may have a hard time cashing out early.

- Must pay capital gains taxes – any profits you make on your investments are taxed at the normal rate for capital gains which can be up to 20%.

Jump to: Full Review

Compare to Other Investment Apps

Fundrise

Invest in real estate properties with a $10 minimum initial investment

Historical annual return varies from 8.8% to 12.4% (2019 – 9.47%)

Low annual fees: advisory – 0.15%; management fee – 0.85%

Public App

Manage your portfolio of stocks, ETFs, and crypto investments – all in one place

Over 5000 stocks and ETFs to choose from (dividend stocks available)

Follow other investors, see their portfolios, and exchange ideas

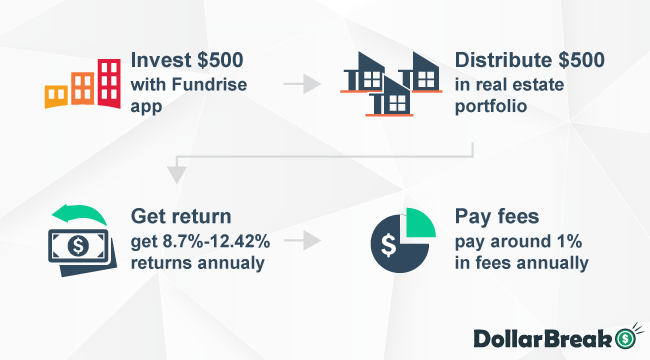

How Does Fundrise Work?

Fundrise is a real estate investment platform that has been around since 2010. The company specializes in crowdfunded investing, enabling non-accredited investors to invest in the real estate market via an e-real estate investment trust (e-REIT).

Fundrise operates similarly to a traditional real estate investment trust (REIT). The platform purchases high-quality real estate assets and rents them out. It groups these assets into different portfolios, and investors on Fundrise can buy shares in these portfolios.

The platform provides multiple investment options, and you can choose between different portfolio options. There are also flexible investment minimum amounts, allowing you to invest as much or as little money as you want.

As you grow your portfolio over time, the value of your investments will increase gradually. You will also enjoy dividends from your investment. The dividends you earn depend on the profits that a portfolio earns, and the share of the portfolio you own.

How Much Can You Earn With Fundrise?

There are two main ways to make money with Fundrise: capital gains and dividends.

Capital gains refer to increases in the value of your investment holdings. You may enjoy capital gains over time as the value of the properties in the portfolio you invested in increases. צו דאַטע, Fundrise has an average annual income return of 5.42%. However, you could earn up to 22% or more in returns in a single year.

On the other hand, your earnings from dividends will be mostly dependent on the earnings of the properties in the portfolios that you have invested in.

Who Is Fundrise Best for?

Fundrise is ideal for anyone who wants to invest in real estate but does not have the funds to purchase entire properties. It is also suitable for people who want to invest in a diversified portfolio without high minimum investment capital.

Fundrise Fees: How Much Does It Cost to Invest With Fundrise?

The platform does not charge any fees to create and maintain an investment account. However, if you choose to invest your money in real estate with Fundrise, you will need to pay an annual advisory fee and an account management fee. These fees are charged once per year and depend on your investment amounts with Fundrise.

The annual advisory fee is 0.15% and it for:

- Reporting performance of your projects

- Providing an automated dividend distribution system

- Composite tax management

- Investor relations and customer support

- Asset rebalancing and fund administration

On the other hand, the account management fee is 0.85%. The platform uses this fee to pay for the operating expenses of over 100 real estate projects, such as accounting, zoning, and construction.

You can expect to pay around 1% in fees to Fundrise each year in total.

Fundrise Features: What Does Fundrise Offer?

Fundrise offers many features to improve your investing experience, such as:

- High-quality portfolios

- Flexibility

- Convenience

High-Qualify Portfolios

Fundrise works with professional investors to ensure that the properties that they include in their investment portfolios are of high quality.

In addition, the company also has a proprietary algorithm that enables it to reduce costs while ensuring that your investments are kept safe.

Flexibility

The platform also provides users with the flexibility to decide how they want to manage their investments. You can invest as much or as little as you wish on Fundrise, and the platform has flexible investment minimums that you can choose from.

Moreover, you can also withdraw your investments during the platform’s designated quarterly windows.

Convenience

The platform provides dynamic asset updates via its website and mobile app, allowing users to track the performance of their properties and investments.

Fundrise Requirements

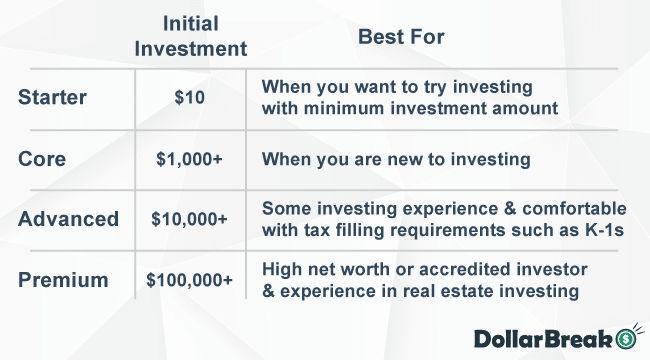

Fundrise offers different types of accounts based on the sum of your investments. The minimum investment amount is relatively low at just $10, allowing you to invest in real estate without committing a large sum.

| Account Level | Minimum Investment Amount |

|---|---|

| Starter | $10 |

| Core | $1000 |

| Advanced | $10,000 |

| Premium | $100,000 |

Fundrise Payout Terms and Options?

Real estate investments generally require time to increase in value. As a result, Fundrise advises users to hold their investments for at least five years. When you invest with Fundrise, you are purchasing shares in physical properties.

Thus, you will not be able to withdraw your earnings easily since the company will need to sell the properties for you to do so. Nonetheless, Fundrise allows you to liquidate your investments once per quarter without penalties.

There are some limitations when withdrawing your funds from Fundrise. You should check to ensure that you meet these requirements to avoid additional fees.

Fundrise Risks: Is Fundrise Safe to Invest With?

Fundrise is regulated by the Securities & Exchange Commission (SEC) of the United States. Thus, your investments with Fundrise are secured, and you will get your funds back if the company goes bankrupt.

Note that investments of any kind carry risk, and there is always a chance that you might make a loss on your investment.

How Does Fundrise Protect Your Money?

Fundrise protects your funds by investing in a diversified portfolio. This means it purchases a wide range of properties with different risk profiles. Hence, you can enjoy a low average risk while enjoying high potential returns.

Fundrise Reviews: Is Fundrise Legit?

Fundrise is a legitimate investment platform that you can use if you want to invest in real estate. The platform has received mostly positive reviews from its users.

Many users praised the platform for providing a smooth user experience and allowing them to manage and update their investments. Investors with Fundrise were also satisfied that it allowed them to invest in real estate without having to purchase and manage property directly.

However, the platform has also received some complaints from users. Some users were unhappy that Fundrise did not allow them to easily withdraw their funds. Apart from their investments being illiquid, some users have complained that the returns in some years are not as high as advertised.

What Are the Fundrise Pros & Cons?

Fundrise Pros

- Low minimum investment amount of just $10.

- Enjoy annual returns of up to 22% per year or more, with average returns of over 5%.

- Low annual fees of just 1% in total.

- Low risk on your investments, with portfolios being diversified.

Fundrise Cons

- You cannot easily withdraw your funds, making investments with Fundrise unsuitable for short-term investors.

- Any of your investment earnings will be taxed as normal income.

How Good Is Fundrise Support and Knowledge Base?

Fundrise provides a comprehensive support and knowledge base on its website. You can find resources for both FAQs and education on the Fundrise website.

The FAQs articles provide the answers to many of the commonly asked questions you may encounter when investing with Fundrise. On the other hand, education resources provide you with market data and analysis to guide your investment decisions.

Fundrise Review Verdict: Is Fundrise Worth It?

Fundrise is one of the best investment platforms that you can use to invest in real estate. The platform has a low minimum investment amount of just $10. Thus, it is ideal for beginner investors who want to invest in real estate without you needing to buy a rental property or commit a large sum of funds.

However, one of the downsides of investing in real estate with Fundrise is that your investments are relatively illiquid. Thus, it can be difficult for you to withdraw your funds, and you can only do so easily during one of the four windows each year.

Despite the limitations, the platform has enjoyed high historical annual returns. Investors with Fundrise can enjoy an average annual investment return of over 5%, with returns exceeding 22% in some years. Thus, it is still worthwhile to invest with Fundrise if you are looking for a place to buy real estate for a long-term investment.

How to Sign Up With Fundrise?

Step 1: Choose a Plan

To start investing with Fundrise, you will need to choose an account level that best suits your investment goals. The platform offers different account levels for investors with different amounts of capital.

As a beginner investor, you can start with a $10 investment in a Starter account before increasing your investment over time if you enjoy using the platform.

Step 2: Sign Up for an Account

After selecting your desired account level, you will need to sign up for an account with Fundrise. You can do so by visiting the Fundrise website and clicking on the Sign-Up button.

To complete the sign-up process, you will need to provide some basic information about yourself and your investments. You will also be able to fund your account after your application to join has been approved.

Step 3: Build Your Portfolio

Once you fund your account, you will receive a dynamic portfolio built for you by the platform. You will also have the option to choose which projects you want to invest in, and you can diversify your investments based on your personal preferences.

Sites Like Fundrise

Fundrise vs. Acorns

Like Fundrise, Acorns is one of the best platforms for beginner investors. Acorns allows you to invest your spare change automatically, and it does so by rounding up your card spending to the nearest dollar.

You can invest in a wide range of different stocks and ETFs with Acorn, starting from a low minimum amount of just $5. However, note that the platform charges a low fee starting from just $3 per month, compared to Fundrise’s 1% annual fee on all your investments.

Fundrise vs. Public

Public is one of the best platforms that you can join to buy and sell stocks and ETFs. The platform allows you to choose from over 5000 different stocks and ETFs, and there is a low minimum investment amount of just $1.

In addition, Public also does not charge any membership or commission fees. Thus, this makes it easy and affordable to start investing with Public. The platform also allows you to follow other investors and review their portfolios and investment ideas.

Overall, if you’re looking to invest in stocks and ETFs instead of real estate, Public can be a good alternative to Fundrise.

Fundrise vs. Stash

Stash is an alternative investment platform to Fundrise that you can use if you want to invest in stocks and other assets in very small amounts.

The platform allows investors to purchase fractional shares, which are portions of shares. This is ideal if the price of a share is very high and you do not want to commit a significant amount of money to a single stock. Fractional investing also allows you to diversity your investments and reduce the risks in your portfolio.

However, you will not be able to invest in real estate with Stash unless you choose to buy shares of publicly-traded real estate investment trusts.

Other Sites Like Fundrise

Fundrise FAQ

What Is Fundrise?

The platform currently has over 300,000 active investors, and its asset transaction value is over $7 billion. Moreover, Fundrise has also paid over $160 million in net dividends to its investors up until today.

Fundrise aims to help individuals invest in real estate assets without requiring them to have a high net worth.

Is Fundrise a good investment?

Based on its historical performance, Fundrise is a top-performing return with the potential for high investment returns. The company’s REITs have performed well over the past few years, with positive returns of up to 22% per year.

Thus, Fundrise is generally a good investment platform that you can use to invest in real estate.

Can you lose money on Fundrise?

All investments carry risk, and there is still the possibility that you may experience a loss on your investments. Thus, do your research and due diligence before investing with Fundrise.

Does Fundrise pay dividends?

Like most REITs, Fundrise distributes the profits it earns from its rental properties to shareholders in the properties. If you own a share in a Fundrise REIT, you will receive dividends from the REIT whenever the company pays dividends.

What is the average return on Fundrise?

The average return on Fundrise is currently 5.42%, although this may change over time.

Is Fundrise good for passive income?

Investing in dividend-paying real estate assets with Fundrise can be a great way to build a source of passive income. By investing with Fundrise, you can enjoy regular payouts as long as you own a share in a Fundrise REIT.

However, note that the dividends that you earn each time may vary depending on the performance of the REIT.