DeFi’s growth in 2021 has been exponential, turning it into a sector now worth over $100 billion. Cosmos Network is clearing great strides while computing brand-new beds to its already robust DeFi infrastructure that includes many eliciting jobs such as Terra, THORchain, Band Protocol, and Crypto.org.

One key points of swelling is the addition of some of the most advanced cross-chain decentralized exchanges( DEXs) that leverage the Inter-Blockchain Communication protocol( IBC ) to enable permissionless and symmetrical trading across numerous Cosmos blockchains and beyond.

The DEX ecosystem within Cosmos is growing quickly. There’s now be made available to new and promising tokens, higher liquidity for smooth trading and expenditure stability, permissionless token schedules, opportunities for generating higher ROI by participating in liquidity puddles, and a lot more. So, let’s take a look at four of the hottest protocols right now and examine why they’re profit resistance 😛 TAGEND

Gravity DEX Osmosis Sifchain Coinswap

Gravity DEX

There’s no doubt that the integrating of the Gravity DEX protocol brands the biggest DeFi milestone for Cosmos Hub to date, allowing for far greater application and utility. Now, Cosmos Hub can function as a ‘port city’ to facilitate a network of interconnected blockchains.

Gravity DEX likewise increases the overall trading suffer with seamless exchanges, dramatically reduced trading rewards, and more advanced trading mechanisms, such as order diaries and quantity executing, that help mitigate the effects of front-run transactions that typically found on Ethereum-based DEXs( such as Uniswap) that specter the average trader.

Using the Equivalent Swap Price Model( ESPM ), Gravity DEX provides users with accurate premium knowledge by delivering the most recent available swap toll. ESPM composes a much fairer simulation and enables deeper trust in the protocol, driving increased usage and practicality as a direct effect.

Access to the advanced cross-chain Gravity DEX protocol is procreated possible through Emeris, an instinctive dashboard which beta edition propelled on August 17.

Users can currently move and swap signs and participate in liquidity reserves across numerous Cosmos orders. Coming soon, aqueducts will connect the Cosmos Hub with other blockchain networks to enrich the Gravity DEX and the entire Cosmos ecosystem.

Operations are fueled by the ATOM token, so the more transactions are facilitated through the Gravity DEX, the more utility the clue ultimately provides for its holders.

There’s an ongoing proposal to build a Cosmos SDK module that will provide LPs with an extra bonus in the form of farming motivations on Gravity DEX, incentivizing LPs to situate greater liquidity and help strengthen the ecosystem of puddles. This initiative is still in the works, with more information to come.

There’s likewise a budget module in the works programmed to distribute inflation and gas fees to different budget contrives according to voting proposals.

In calls of safety and security, Gravity DEX could be considered the safest protocol within the Cosmos ecosystem, as it’s secured by over $10 billion in ATOM token liquidity to support the network. Additionally, the Gravity DEX has experienced two successful Cosmos SDK Liquidity Module Reviews from blockchain technology firms: a Security Audit by Least Authority and a Code Review by Simply VC.

In Q4 2021, Cosmos Hub will too be implementing a new Interchain Security feature where it, and other large Cosmos series, can share security through lending assets in order to better to confirm blocks on smaller orders. The add-on of Interchain Security maintains centre minimalism by countenance each unique peculiarity become an independent chain certified by the same ATOM validators. Furthermore, it will help more easily deploy and run independent secure decentralized blockchains, preserving the open-source nature of the Cosmos ecosystem.

Osmosis

Next in the Cosmos DeFi ecosystem is Osmosis, an IBC-integrated AMM( Automated Market Maker) built using the Cosmos SDK framework. The Osmosis core business model is centered on two all-important benefits of DeFi: modularity and privacy. These parts are important to DeFi because they spark creativity and innovation while give full obscurity to protect user identities.

Osmosis’ underlying plan is designed to be fully customizable by providing makes with maximum autonomy to build and deploy their very own practice AMMs by means of a “plug and play” model.

In words of privacy, Osmosis uses cryptography to create shielded liquidity funds, thereby mitigating the issue of front-running and ensuring that balances and events remain invisible. This privacy helps customer safety and security so their online attendance and portfolio remain anonymous.

By use the$ OSMO token, incumbents retain the ability to vote on proposed project alters, circulate liquidity minings reinforces for consortia, and more. Osmosis also plans to introduce “superfluid staking” that causes$ OSMO owners use the token for simultaneously staking and providing liquidity to funds, thereby maximizing the economic value between the liquidity provider( LP) and security of staking.

Osmosis have already established a decentralized OSMO token allocation model to encourage alignment with Cosmos Hub’s society — this will be attained by distributing its part genesis ply to Cosmos Hub reports through its already ongoing’ quadratic fairdrop’. A snapshot has already been taken and to earn the airdrop rationing, useds need to engage in multiple on-chain pleasures like staking, and governance.

Taking muse from mechanisms like quadratic voting and quadratic fund, the quadratic airdrop is meant to decrease the dispensation difference in the new governance mount, while still recognizing the contributions of bigger stakeholders. It will reinforce Cosmos Hub accountings that involved in independently staking, while reducing the amount of OSMO clues be assigned to ATOMs stored in exchange of views among whales.

Sifchain

Sifchain is a cross-chain IBC-enabled DEX built with the Cosmos SDK. Users can easily swap and fund between the native$ ROWAN token, ERC-2 0, and Cosmos digital assets, all more cheaply and efficiently than exercising existing DEXs on Ethereum.

To achieve Sifchain’s mission of rendering the highest possible asset transfer value between Ethereum and Cosmos, the team integrated “Peggy”, a bridge from Cosmos to Ethereum, in early 2021. Peggy abuses pegged clues so token owners on either side can access and reap the benefits of their assets on both chains, although we are bundling liquidity.

Sifchain governance is decentralized and promotes on-chain through$ ROWAN, where users can decide on adding brand-new pegged signs to the ecosystem. Sifchain has implemented SifDAO, a decentralized autonomous administration( DAO) -based system, which is a community-governed organization absent of central leadership where decisions are realise based on a set of rules carried out on the blockchain.

SifDAO operates independently of the DEX while serving as a backer to its future development.

The Sifchain DEX has also implemented ongoing liquidity pools( CLPs ), where consumers need to provide$ ROWAN in addition to any other Sifchain-supported asset. As a cause, LPs can deserve compensations and speculators are able to borrow liquidity to execute margin business. Asymmetric pooling is another one of its key features, adding users with the flexibility to deposit any amount of clues into a liquidity pool.

Coinswap

Last but not least, Coinswap is a cross-chain AMM module for dapps within the Cosmos ecosystem built on IRISnet( or the IRIS Hub ), an interchain work centre built on Cosmos SDK — it’s connected with the Cosmos Hub and provides liquidity for assets associated across the different Cosmos chains.

The Coinswap Web Application is the gateway to using the AMM, allowing users to swap signs, lodge or withdraw liquidity from puddles, and participate in yield farm — anyone can begin trading by connecting either their Keplr or WalletConnect web wallet. WalletConnect leveragings IRISnet’s HTLC module to connect with Binance Chain, allowing for cross-chain movements of assets such as BUSD and BNB on Cosmos.

But there’s more now than fulfills the eye — IRISnet will be deploying the Terse IBC( TIBC) protocol, simplifying the IBC by connecting one smart contract as the overall channel for EVM-compatible blockchains. TIBC will also support NFT( non-fungible token) cross-chain gives from the IRIS Hub to the OpenSea programme. In essence, this protocol allows for promoted application and greater synergy between the DEXs across the Cosmos ecosystem.

$IRIS is the platform’s native token, which supports and secures the underlying network. Coinswap has connected with StaFi so users can stake Cosmos-based tokens and receive rTokens( the asset’s staking derivative) as compensations. These rTokens( such as rATOM and rIRIS) can be traded on other DEXs and applications, heightening clue practicality and application across the Cosmos ecosystem.

Comparison

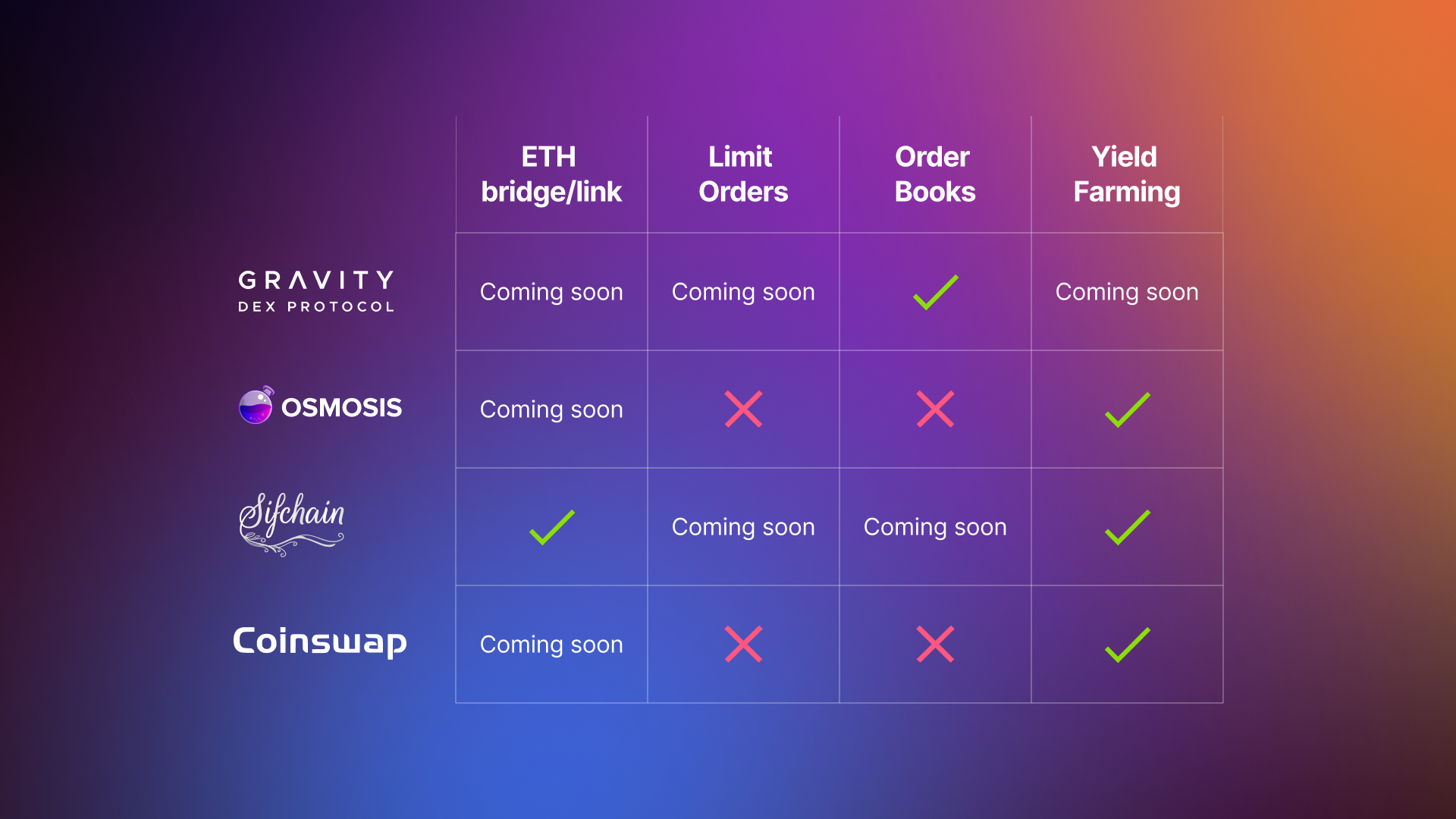

Let’s take a closer look at the main features of these DEXs and reflect a light on their similarities and divergences to better understand how these etiquettes fit under the Cosmos umbrella 😛 TAGEND

Although not all of these protocols offer stablecoin assistance yet, more interconnectivity is on the way. The Terra ecosystem announced today that it connectivity to Cosmos by Sept 29 after Columbus-5 Upgrade, intending its stablecoins will be available for trading across all of these DEXs, accommodating deepened practicality to Cosmos Hub and beyond.

Gravity DEX, Osmosis, Sifchain, and Coinswap are just a few examples of how decentralized protocols can coexist within the Cosmos ecosystem consuming the IBC — its full potential is limitless.

Each DEX comes given with its own unique set of features, so it’s recommended that users keep the following considerations in intellect when making their selection 😛 TAGEND

Security/ Liquidity: Total price locking the bond, total ethic locked on the DEX/ in the ponds, and verifiable security of the system and framework for utilization Historical Track Record: History of the chain’s production, ongoing increases, and milestones smacked User Interface: Design, usability, and seamlessness of the trading know Advanced Trading and Rewards-based Mechanisms: Availability to stake, farm, and utilize innovative trading tools, such as order journals and restriction lineups

Regardless of which causes customers choose to prioritize, it’s important to keep in mind that the technology behind these protocols and aspects is still early. Everyone should conduct their own research and understand the accompanied likelihoods before trading.

Also published here.

Read more: hackernoon.com