Commenting on a recent essay, Carmine Red questioned an excellent question 😛 TAGEND

How do you evaluate the financial advice you get from other sources? Solely, how do you decide if some section of admonition is for you, or if you should discard some contiguou suggestion. Is there an amount of pick-and-choose?

GRS certainly doesn’t seem like a dogmatic 100% one-way-of-doing things site, so I’d love to hear about the critical thinking you employ, and that I’m sure we can all use a little of since we’re coming attacked by business “do this! ” or “don’t do this” instructions from so many different dimensions.

Carmine is right: GRS is not dogmatic. From the beginning, my top admonition has been” do what works for you “. By this I mean that you should test financial opinion to see if it work for you and your place. There’s little( if any) opinion that applies to 100% of beings in 100% of cases. Life is chaotic. Fund is messy.

So, how can you decide whom to rely? How can you assess a piece of fiscal suggestion to decide whether it has merit? And if the IVA Help & Advice does have quality, how can you tell if it’s right for yor life?

Today, let’s take a deep dive into this question. Let’s explore how to evaluate all of the financial advice you get — from the internet, from television, and in real life.

How to Evaluate Financial Advice

Before I rebut Carmine’s question immediately, I want to approach it obliquely. If you find this section boring, delight ricochet to the next one. I won’t nursed it against you!

In 1940, Mortimer J. Adler publicized How to Read a Book, which contained 400 pages of advice on doing something that most people would disagree needs no instruction. In 1967, he rewrote the book and turned it into a bit masterpiece.

In the revised edition, Adler argues that there are four levels of reading 😛 TAGEND

Elementary Reading. At this basic level, the reader is able to answer the question,” What does the decision say ?” But reading at this stage is a mechanical routine. Inspectional Reading. At this statu, a reader’s aim is to get the most from a diary( or clause) in a minimum of time.” Inspectional reading is the art of skipping systematically ,” Adler writes. Your aim is to get a surface understanding of the book, to answer the question,” What is this book about ?” Analytical Reading. At this height, you’re doing the best, most complete and thorough reading of a notebook that you can do. Inspectional reading is done instantly. Analytical learning is done without a time limit. Its propose is understanding. This is the sort of reading that most of us do most of the time. Synoptical predict. At the fourth( and highest) elevation of decipher, we predict comparatively.” When reading synoptically ,” Adler says,” the reader speaks numerous journals , not just one, and residences them in relation to each other .” My ongoing project to read about the history of retirement? That’s synoptic learn.

What has this to do with evaluating monetary advice? Well, I meditate same principles apply. When you receive a piece of monetary advice from somebody, or you read a recommendation online, the authorities have four levels of evaluation.

Elementary evaluation. When you pick up a piece of fiscal suggestion, begin by asking yourself” What does this advice say ?” You’re not trying to judge its merits. You’re merely trying to parse the recommendation. Believe it or not, you can throw some trash out at this statu because it doesn’t say anything. Or what it says is nonsensical.( I don’t planned laughable as in” I disagree with it “. I entail laughable as in it literally represents no gumption .) Inspectional evaluation. Next expect,” What is this advice about? What is the overall letter? What is its core disagreement ?” You’re not trying to understand nuance now. You’re trying to get the main point. For example, in Mr. Money Mustache’s popular essay ” The Shockingly Simple Math Behind Early Retirement “, the core disagreement is” the more you save, the sooner you can retire “. The main point of the section you’re reading right now is:” There are smart ways to evaluate fiscal advice. Now are a few .” Analytical evaluation. The biggest part of evaluating financial admonition is taking time to analyze it, to examine the advice in detail, to really understand it. This usually means requesting “why?” Why is the person giving their recommendations? What’s their incitement and what does this advice aim to accomplish?( The remainder of such articles proposals some tips for applying this step .) Synoptical evaluation. Lastly, if you’re evaluating important admonition( such as how much to spend on a room ), you should make time to do some comparative assessment. What do other beings have to say? Why do they agree? Why do they agree? How does this advice fit in to what you already know and what you’re already doing?

Here at Get Rich Slowly, one of my primary aims is to” estimate synoptically “. I don’t want this area to be one-dimensional. When I write my essays, I try my best to draw from a variety of subjects and sources. I “ve been looking for” differing sentiments. Does that planned I digress from strict personal finance sometimes? Yes, absolutely. But it utters the writing most interesting for me and, I hope, for you.

Okay, that’s some semi-helpful, high-level philosophical material about evaluating monetary admonition. Now let’s look at how to articulate this into practice. How do you actually analyze business opinion to decide whether it’s good or not?

I think it helps to ask four questions.

Does This Advice Mesh with Reality?

Some advice plans off my Bullshit Detector. Rhonda Byrne’s mega-bestseller The Secret[ my review] is a classic speciman of this. Byrne claims that your life is created by the things you think about. There’s an element of truth to this, but she takes it to an irrational extreme.

I planned, look at this bullshit 😛 TAGEND

Thoughts are magnetized, and designs have a frequency. As you think, those meditates are sent out into the Universe, and they magnetically captivate all like things that are on the same frequency. Everything sent out returns to its root. And that informant is You.

[…]

To lose weight, don’t focus on “losing weight”. Instead, concentrating on your excellent heavines. Feel the feelings of your perfect force, and you will summon it to you.

It makes no time for the Universe to certify what you require. It is as simple to certify one dollar as it is to manifest one million dollars.

The fiscal “advice” in The Secret is premium, high-grade bullshit. It doesn’t mesh with actuality. I know from experience that I cannot “manifest” a million dollars. I cannot” envisage checks in the mail” and then using them to magically appear.( Dangerously, that’s one of the missile qualities in her record:” Visualize checks in the mail .”)

This is an easy sample. Often, it’s more difficult to determine whether business admonition is reality-based.

For instance, “theres a lot” of vesting organizations out there. Their proponents sincerely believe in them. They can be passionate when they please explain how their systems run. Testing whether or not investing advice meshes with actuality can be complicated and confusing. I find places like this stymie, which is why I try to avoid exceedingly complicated advice in favor of simplicity.

This brings up a tangential but important point. When probable, I favor simplicity.

Yes, perfectly yes, fund can be messy. It can be complicated. And not all complicated admonition is bad advice. Some complicated advice is great, in fact. Todd Tresidder at Financial Mentor has built his entire brand on complicated admonition. But he’s not a fake. He’s the real deal.

For me, though, Todd’s business opinion is overly complicated. I favor simple. I’m an” 80% answer” kind of guy. That’s why I’m good with Dave Ramsey’s version of the debt snowball, even if it’s not mathematically optimal. That’s why I like investing in index funds. These programmes are simple and effective even if they don’t provide optimal ensues.

Is This Person Qualified to Give This Advice?

I’ve found that people are quick to offer advice on subjects for which they have little or no understanding. And, in fact, it’s typically the people who know the most about a subject who are slowest to make suggestions — and their suggestions are full of caveats and qualifications.

I have various friends who love Bitcoin as an” asset opening”, for example. Yet, these same friends don’t understand the fundamentals of basic investing. It’s difficult for me to make their cryptocurrency recommendations gravely when they can’t explain what a stock is and why you might want to own one. Or a attachment. Or any other traditional investment. They might understand the technical details behind Bitcoin, but they don’t understand investing, so I don’t listen when they try to sell this as major investments opportunity.

This same principle applies to financial guru. Sometimes an expert in one field tries to offer advice in a related field, but that suggestion isn’t undoubtedly good.

Dave Ramsey is an expert on debt reduction. He’s lived it. He’s been schooling about it for twenty years. He knows what works and what doesn’t. I trust his debt suggestion. I do not trust Ramsey’s investing advice. He performs bold claims that are demonstrably false . On the other handwriting, I trust Warren Buffett’s investment advice. He’s one of the greatest investors the world has ever known. When he was of the view that 99% of investors ought to use index funds, that carries a lot of load. But if he were to offer advice on getting out of debt, I would treat it with some agnosticism. Buffett has never been in debt and cannot understand what the experience is like.

I can’t think of any professional I trust 100% about all topics. I don’t believe it’s possible for a person to know everything about everything. Plus, so much of personal investment is personal, right? Sometimes an expert’s advice might be right for most people but, for whatever reason, it might not be right for you.

I is certainly not a studied monetary professional, and I try to start that abundantly clear at all times. Anything I know, I’ve learned from the school of hard knocks. Because of this, I do my best to be transparent about what I do and do not know.

When I write of investing, for example, I quote my informants. I explain where I’m getting my information materials and why I believe it. I don’t expect you to accept my recommendations because I am the one shaping them. But if I can show you how I learned something, perhaps it’ll is helpful for you too.

On the other hand, I’m an expert at realise blunders. You should rely me there haha.

How Does This Person Profit from Their Advice?

I’m generally a positive, trusting fellow. I’m probably too relying. I believe that people are generally good.

That said, I’ve learned to be skeptical when people offer financial admonition. Do they have an ulterior motive? How might they benefit from the advice they’re offering? If they interest, how does that colouring their recommendation?

I’ll offer me and my colleagues as prime examples.

I’ve written before about how bloggers tread the thin green word. Most bloggers mean well, but their goals get gloomed when they see how much money they are able to impel writing about this produce or that work. Their advice can turn from selfless to selfish.

Here’s a specific example. I almost never trust online credit card and bank critiques. These reviews are not objective. Their aim isn’t to provide you with the info you need to make a decision, but to encourage you to sign up for an account. And bloggers utilize all sorts of insidiou methods to make that happen. I don’t like it.

This is the primary intellect you’ve never seen me do a credit card review. I do want to review the card I use most often, though, and I’ve been working on an section about it for nine months away. When I publicize that post, you can be sure the review is based on my experience and I’ll offer disclaimers if I make money from the review.

( Trivia: Until this year, I had never made a penny from credit cards. Zero dollars. Zero cents. That’s changed now, though, since the introduction of our travel credit card implement. Now I’ve made a few hundred dollars from credit cards .)

At the opposite extreme, look at somebody like Mr. Money Mustache. When he writes about things like getting rich with bikes, he has no ulterior motive. He’s not trying to trick you into putting money into his pocket by to purchase a bike. He doesn’t profit from this recommendation.

Instead, this is something that Pete guesses. He am of the view that biking is better for your health and your rich. It’s advice he adhered to by himself, that he places into practice daily. And because this is genuine advice without a monetary intention, I’m more likely to accept its validity.

This idea even applies to professionals. A real-estate agent is probably prevented from steering you to the most expensive house, but there’s nothing preventing her from spurting nonsensical like,” You should buy as much home as you can afford .” That’s risky advice that throws people into precarious financial situations — yet produces a bigger commission for the agent.

Always ask yourself how the person or persons providing advice stands to benefit from the advice they’re offering.

What Are the Other Options?

When you’re trying to decice whether or not to accept a piece of fiscal suggestion, explore other alternatives. Seek other options and approaches.

It’s very rare in the world of coin( and the world in general) that there’s merely one action “right” style to do something. There are often multiple good comings to a problem. This can make it hard to pick the one that’s best for you.

Budgeting is a great example. There are dozens( hundreds ?) of different approaches to building a household budget. Choosing a system can be overwhelming. How can you decide which alternative is best?

Honestly, you can’t. And you shouldn’t even try.

Instead, forget about ” best “. Focus on “good”. When selecting a budget system, use trial and error until you find one that works well for you. Once you’ve noted a fund that works, stop actively prosecuting other options. Don’t close yourself off to the idea that you might stumble upon a better alternative in the future, but stop outlaying energy trying to find a excellent solution when you already have one that works.

A corollary to this principle is that you shouldn’t stick with a piece of suggestion simply because somebody told you that it’s the best( or the “right”) method to got something. Who attentions? If very best( or “right”) course isn’t effective for you, then let it go.

My friend Paula Pant once told me,” An imperfect plan you’ll stick with is better than a excellent intention you won’t .” Exactly.

From day one, my adage here at Get Rich Slowly has been: Do what works for you. If something isn’t effective for you and your place, abandon it. Don’t stick with something out of the mistaken belief that you’re a flop for choosing another option.

Guidelines for Evaluating Financial Advice

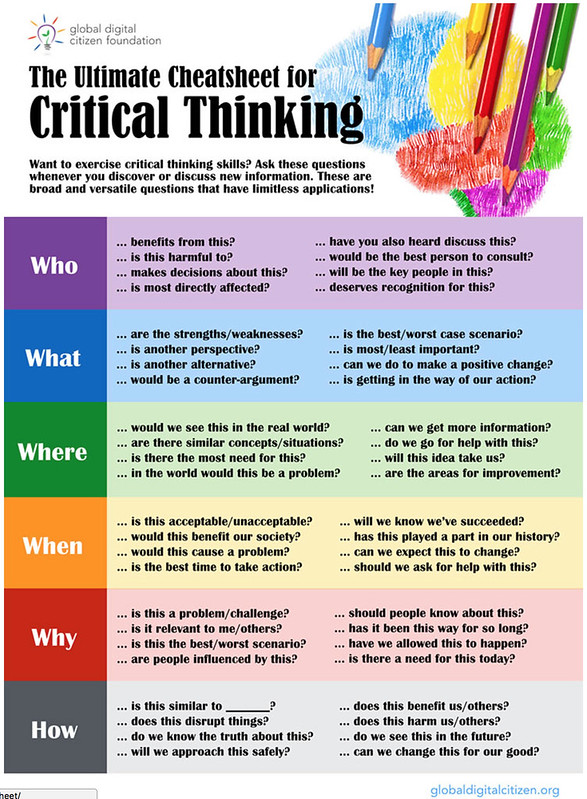

Evaluating monetary advice is an extension of critical thinking as a whole. If you become a better critical philosopher, you’ll make better decisions regarding the advice you receive. And the more you rehearsal, the most wonderful you’ll become.

For my part, I’ve been reading about personal commerce extensively for the past fifteen years. In that time, I’ve read( and sounded and viewed) all sorts of suggestion, much of it contradictory. At first, I procured this confusing. In time, though, I’ve developed a set of rules( or guidelines, if you prefer) to help me better evaluate the financial advice I receive.

Here got a few 😛 TAGEND

If it clangs too good to be true, it was likely is.( I want to say,” It always is” — but I dislike absolutes .) Verify, authenticate, substantiate. Don’t blindly follow somebody’s advice. If someone makes a suggestion that rackets reasonable, research what others say both for and against the relevant recommendations. Don’t prostrate the baby out with the bathwater. If you’re an atheist, don’t ignore Dave Ramsey’s debt advice simply because he’s Christian. If you’re republican, don’t dismiss Elizabeth Warren’s balanced money formula simply because she’s socialist. Even kinfolks you don’t like can have smart-alecky plans. Indulgence clarity. Complicated advice and involved systems too often hide flaws and problems and traps. Plus, intricacy leads to misunderstanding. With fund, purity is a virtue. You don’t have to do every part of good opinion. I recognize, for example, that real-estate investing can be profitable. It’s an excellent way to build wealth. Still, I don’t want to do it — so I don’t. Check certifications, when pertinent( peculiarly when asking questions technological and/ or legal advice ). You can good recommendations from folks without credentials, and you can get bad advice from experts. But generally speaking, modified experts are a terrific resource.

Plus, I’ve learned to ask four basic questions when I’m evaluating a new piece of business advice.

How does the person giving the advice profit from it? How do I benefit from the advice? How does society benefit from the advice? Has the other person been successful following their own advice?

This last question is important. If this article weren’t so long once, I’d dive deeper into it. But let’s speedily use Bitcoin and index monies as an example. When parties recommend Bitcoin to me, I question how they’ve done with their “investments” in cryptocurrency.( Typical answer: Not well .) Same thing with index stores:” How have you done ?”( Typical answer: Reasonably well .)

People love to throw out advice that either they don’t follow or that hasn’t actually worked for them. I’m not sure why that is, but it’s true.

For my part, I try to steer clear of things I don’t understand. I’m not perfect. I establish corrects. But when I constitute misconceptions, I try to fix them as quickly as possible. Also I’m willing to learn. When I started GRS in 2006, I didn’t know what an index money was. I mulled expending was all about picking inventories. Then I was informed about passive investing. Today, I have a more nuanced approach.

The post Which business advice should be used trust ? performed first on Get Rich Slowly.

Read more: getrichslowly.org