The H greatest IRAs to open in 2020

I get this issue from a reader worded Kelsey a while back 😛 TAGEND

“I haven’t started a Roth IRA yet, but I are planning to formerly I graduate from college. Where should I begin looking for the best one, and how can I tell that they are good? ”

Great question. Not exclusively is it important to start investing early, but you should also make sure that you pick the right details to do it in.

That’s why I’m going to show you how to evaluate a good brokerage as well as give you my recommendations for which ones you should open.

Vanguard Charles Schwab Ally Betterment Fidelity

How to find the best IRAs How to open an IRA What’s an IRA and why should I have one ? REMEMBER TO INVEST ! Automatic investing

The 5 best IRAs of 2018

Below are some of my favorite IRAs for 2018. When you’re done checking out the recommendations, be sure to keep reading to find out how you can set up an automatic plan so you give passively.

1. Vanguard- Best Funds

Vanguard is what I use — and they’re a fantastic brokerage due to their low-cost monies and immense customer support. They’re a tried and true option when it comes to the investing world.

No account minimum Automated investing Most stores require a minimum $3,000 BUT there are funds you can purchase for as low as $1,000 $20 account service fee BUT it’s forfeited if you sign on for their statement e-delivery service Commission-free ETFs when transactions within your brokerage history

2. Charles Schwab- Best Overall

Schwab is a exceedingly reputable and reliable brokerage on top of provide one of the best chequing account out there. Plus if you do have a checking account with Schwab, they’ll automatically associate the brokerage account to it. Very handy for automated investing.

No minimums to open account No maintenance fees No fees for Schwab ETFs Low-cost monies Automatic devoting

3. Ally- Best Rate

Ally is an online bank — and they’re a great choice for anyone looking for an IRA. Since they’re online, they don’t have to deal with a knot of overhead and pass their savings onto their clients.

No minimum opening extent No maintenance rewards Low commissionings Offers many other IRA products like IRA CDs and IRA Online Savings Accounts to add to your chronicle.

Betterment- Best for Hands-Off Investing

Betterment is a magnificent option if you’re looking for a painless, hands-off investing experience. They’re a robo-advisor that provides customers with boasts like automated rebalancing for when your stocks and bonds start to stray from your demanded asset allocation. They’ll too let you determine your own risk tolerance to assist you build a great portfolio that’ll work for you. Overall, a great choice if you’re looking for a robo-advisor.

No minima to open account 0.25% handling rewards Automatic rebalancing Automated vesting Goal-setting tools

Fidelity- Best for Newbies

Fidelity offers an instinctive knowledge for anyone just getting started in investing, while providing plenty of advantageous stores and hands-on tools for those more experienced in investing very. The pulpit also comes with no rewards for trading stores yourself, and they also host a big catalog of enormous ETFs. If you’re looking for a intermediary to help you transactions, though, you might find yourself saddled with a cost to do so. Overall, it’s a great place to start if you’re brand-new to investing.

No minima to open account No costs per sell Immense list of ETF options 24/7 customer service

How to find the most wonderful IRAs

Contributing as early and as much as possible is important since each dollar you give will be worth much, something much with time.

To start, you’re going to need to open an investment brokerage account with a relied investment company. Think of the “investment brokerage account” as your mansion, and the IRA as one of the rooms.

Although this account will probably hold only your IRA, you’ll be able to expand it to hold other accountings later( e.g ., taxable speculation chronicles or added Iras for your spouse and kids ).

When it comes to finding a good IRA, you need to look at three orbits 😛 TAGEND 1. Low open costs

You’ll want to compare minimum required investments before you open the investment account. For pattern, some full-service brokerages require you to have a hefty minimum amount to open an account.

A while back, I called up Morgan Stanley and a representative recommended a minimum balance of $50,000.

“Technically, you are eligible to open an account with $5,000, ” she said, “but the costs would kill you.”

This is why you use a discount brokerage. Most do require a minimum reward of $1,000 to $3,000 to open an IRA — but sometimes they’ll waive it if you set up an automatic transportation cost. Which draws us to…

2. Automatic speculation

The second thing you want to look for is an IRA that’ll allow you to automatically invest your money.

IWT is all about automation. It makes the ache out of investing yourself each month and allows you to situated a monetary method in place that’ll earn you fund passively.

With an IRA automated displace, your brokerage will automatically take money out of your checking account each month and invest it where it needs to go.

Even if they don’t, that’s okay. You can set up a monthly automated carry-over so your fund will grow without you having to think about it( more on that last-minute ).

3. Good facets

You should also investigate characteristics of the account.

Will you have 24/7 customer services? Is the online boundary easy to use? Are there reputable fiduciaries ready to answer any question you have? You should be able to call them up on the phone and get recommendations for people like you to invest.

While you should absolutely devote some time looking for an IRA with those three things, the most important thing is you get started.

Yes, you could spend hundreds of hours doing a detailed comparison of the number of members of stores offered, frequency of mailings, and alternative-investment notes available, but more coin is lost from ambivalence than bad decisions.

Just pick one of the three above and get started.

How to open an IRA

All of these plazas render an excellent variety of funds to choose from, so you can’t go wrong with them.

Signing up is easy too. Follow the steps below to open one up today.

NOTE: Make sure you have your social security number, supervisor address, and bank info( account count and routing multitude) accessible when you sign up, as they’ll come in handy during the application process.

Step 1: Go to the website for the brokerage of your select. Stair 2: Click on the “Open an account” button. Each of the above websites has one. Stair 3: Start an application for an “Individual brokerage account.” Step 4: Enter information about yourself — figure, address, birth time, supervisor info, social security. Stair 5: Set up an initial deposit by entering in your bank information. Some middlemen require you to make a minimum deposit so use a separate bank account in order to deposit money into the brokerage account. Stair 6: Wait. The initial commit will take anywhere from 3 to 7 days to complete. After that, you’ll get a notification via email or phone call telling you you’re ready to invest. Pace 7: Log into your brokerage account and start investing!

The application process can be as quick as 15 minutes and will put you on your route to a Rich Life.

What’s an IRA and why should I have one?

An individual retirement account( IRA) being invested accounting that gives you amazing tax advantages for retirement saving.

The two common types 😛 TAGEND

Traditional IRA. This account allows you to invest pre-tax income. You’ll roll over your 401 k into a traditional IRA whenever you leave a job. Currently, anyone younger than 70 1/2 -years-old is allowed to contribute to a traditional IRA. Once you smacked that age, you are required to take out a minimum withdraw each year that is a specific percentage of your monies. Roth IRA. This account consumes your after-tax money to invest, giving you an even better agreement on your investment, as you’ll too offer no taxes on any increases when you withdraw on it. There are currently no age restrictions on a Roth IRA — however, there are income regulations.

Currently, there’s a yearly maximum investment of $6,000 to both histories ($ 7,000 if you’re more than 50 years old ). A Roth IRA currently has an income limit of $135,000 for single tax filers and $199,000 for married couple seam filing. A traditional IRA has no such limits.

However, these limits change often, so be sure to check out the IRS contribution restrictions page to keep updated.

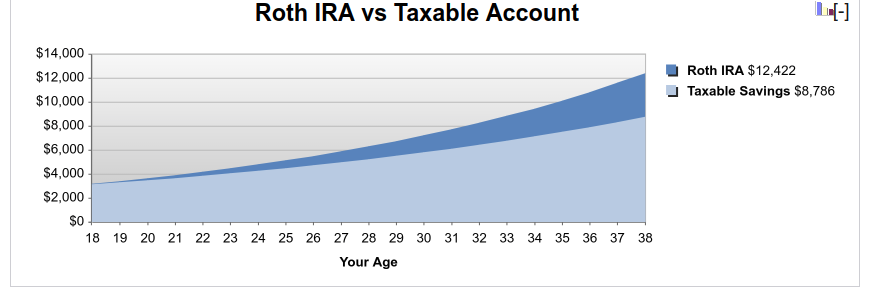

Though there are advantages to both IRAs we most recommend you get a Roth IRA. It’s one of the best financings you can make as a young person. It’s simply the best deal I’ve felt for long-term investing.

If Roth IRAs had been around in 1970 and you’d endowed $10,000 in Southwest Airline, you’d merely have had to pay taxes on the principal amount. When you withdrew the money 30 years later, you wouldn’t have to pay any taxes on it…

…which is good because that $10,000 would have turned into $10 MILLION.

Overall, occasion is your best friend when it is necessary to your Roth IRA. And over numerous, many years, that’s an astonishing deal.

REMEMBER TO INVEST!

An IWT reader wrote me about a exchange she had with her friend a while back. The friend mentioned she’d been contributing to her IRA for nearly 20 years.

And then … she mailed me this email.

“Wow that’s enormous! ” I said.( The IWT reader .)

“Yeah, but it’s just increased at all.” I felt a sinking feeling.

“You know you have to buy the funds right? It’s not enough to transfer money into an IRA, you have to choose the allocation.”

“What? ” she said.

RAMIT, MY FRIEND HAS BEEN PUTTING MONEY INTO A ROTH FOR OVER 10 YEARS AND NEVER SELECTED Fund. IT’S A GLORIFIED SAVINGS ACCOUNT. SHE’S MISSED 10 YEARS OF INVESTMENT GROWTH WITH COMPOUND INTEREST. I DON’T KNOW IF I’M MORE ANGRY OR SAD.

Holy shit.

She’s right. Very few professionals are ever crystal-clear in telling you that you need to actually INVEST your coin when you have a Roth IRA( you can find these instructions in Chapter 7 of my notebook ).

The worst part? The $3,000 her friend “invested” could have been worth more than $ 12,000 today. That’s $ 9,000 in EFFORTLESS money — and because it’s a Roth IRA, those earnings would have been tax-free.

You know I had to ask how her friend felt when she learned the truth.

” I feel various kinds of cheated, ” she says. “I could have been earning more fund for all of these years, hitherto no one ever told me about this important step.”

This is why I started writing IWT. This gal went out of her behavior to get instructed. She went as far as opening a Roth IRA and even lent thousands of dollars. But because she didn’t understand the insignificant technological features of this pension account, she lost out on $9,000 of tax-free earnings.

Should she take some responsibility for not knowing exactly how a Roth IRA operated? Of course.

But it shouldn’t be this hard. You shouldn’t have to be a financial expert to have your money do the right thing, just like I shouldn’t have to understand how a carburetor been working to drive my car.

That’s why I wrote my New York Times best-selling book on personal busines — so you could use my monetary arrangement, and in six weeks, automatically become your money exit where it needs to go.

So remember: An IRA is just an account. Once your coin is still here, you have to start investing in different funds to see your money grow. I cherish target-date funds for most investors, which you can find in Chapter 7 of my book.

Invest in your IRA automatically

Finding a great IRA to begin investing is just the first step to saving for future developments. If you Genuinely want to build a financial method that’ll help you earn money passively, you need to automate your finances.

To help, I’ve made a 12 -minute video on how to do accurately that. Merely enter your name and email below and I’ll show you how to create a personal finance system that’ll save and pay you money passively for years to come.

The 5 best IRAs to open in 2020 is a post from: I Will Teach You To Be Rich.

Read more: autocreditsoftware.com