In our previous affix Equity-Never been so Bad so Quick. What Next ?~ ATAGEND we looked at how the current fall has been the fastest and deepest in a long time.

Although every Bear market where Index precipitates 30 -6 0% and Broader Grocery 40 -7 0% is different but what we have noticed is the amalgamations have some similarity.

A consolidation after a big market fall has some common characteristics.

The Leading Sector is not recover faster.( Banks have not been able to retrace 50% but Nifty has) Broader Business not able to retrace and depart sideways at relatively low volumes. The Trend Change is confirmed via higher high-pitcheds. Laggard Areas and some New spheres/ list of stocks start evidencing backbone and leadership deepens.

A trend change is confirmed whenever intermediate high-pitcheds are crossed and trendline breakouts.

This is a Long Post. Do spoke till the end.

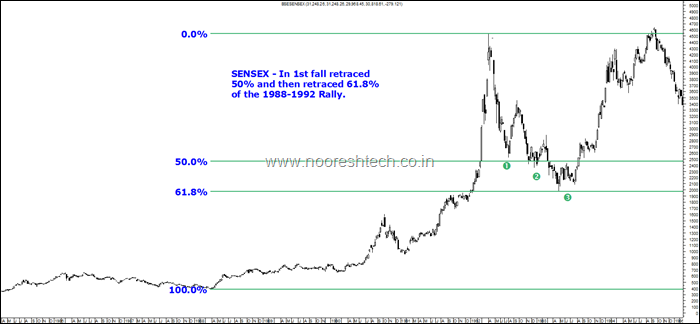

Let us start with 1992 Fall. We do not have a lot of furnish data but will only look at the index.

1) 1992 -1 993 amalgamation.

a) The Fall

Generally the tumble after a bull market can retrace 50 -6 1.8% of the Bull market.

In the first descend of 40-45% from crest the Sensex retraced 50% of the rallying of 1988 -1 992 which was almost 4x from 1988 lows.

By the next two lows it had retraced 61.8% of the move.

b) The Consolidation

From the first fall the consolidation make a precipitate wedge/ triangle previous nearly a year or 49 weeks.

c) The Trend Change

When A corroboration came when the downward trendline and higher top was prepared August 1993. In the next 1 year the Sensex rehabilitated previous high-pitcheds.

Identifying Bottoming Out Patterns coverings this topic in details in the – Online Technical Analysis Course

d) Stock Specific Behavior

Generally 50% of the stocks do not acquire new lows in the amalgamation as broader marketplace tendencies to overshoot on the downside in the first descent itself.

2) The 2000 -2 003 Consolidation

a) The Fall

The first fall did interrupt in different regions of the 61.8% crisscros. But pole a convalescence it again reached 3 brand-new fannies and made a full retracement.

b) The Consolidation

After making a major foot in September 2001 and a 40% rebound from the lows it obligated 2 higher freighters. The Consolidation lasted 3 years from the 1st foot and nearly 2 years from the final foot shaped in Sept 2001.

c) The Trend Change

A trendline breakout from a triangle and a higher high have taken place in mid of 2003 and the Index went back to same high-priceds in the next 6-8 months.

d) Stock Behaviour

( The data is only NSE and has a lot of survivorship bias as it does not consider companies delisted, demerged. Also many companies used to be only listed on BSE)

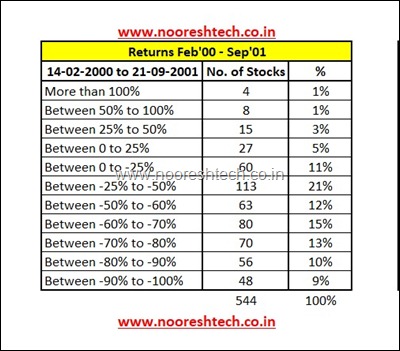

February 2000 to Sept 2001- Sensex down from 6150 to 2600.

58% of the stocks precipitated more than 50%( could be higher as many companies folded .) 47% of the stocks descended more than 60% Only 10% had a positive return.

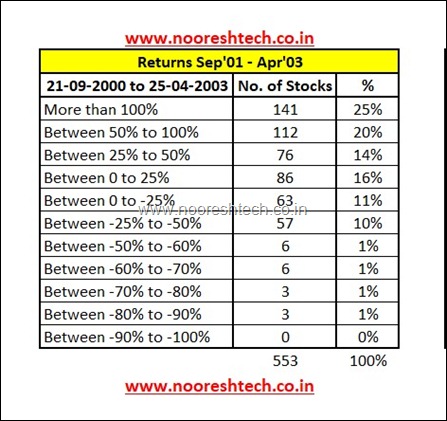

Recovery from the Lows of Sept 2001 to April 2003. Sensex from 2600 to 2900.

75% of the stocks had positive return and higher then 2001 tushes. 46% of the stocks were up more than 50%.( 250 stocks .) 25% of the stocks were up more than 100% from the 2001 lows.

Even though Nifty/ Sensex was an increase 10 -1 2% from the lows. Nearly 141 capitals or 25% of the NSE assets had redoubled in those 2 years.

The End of the Consolidation February 2000 to April 2003

43% of the stocks were down 50% from the 2000 high-priceds. 29% of the stocks had a positive return and had intersected the highs of February 2000 !!

1999-2000 Bull market was IT and Telecom. The residue of the market had already been in a sideways sell from 1998.

d) Sectoral Change

We do not have a lot of Indices data for 2000 -2 003 but there are some on BSE

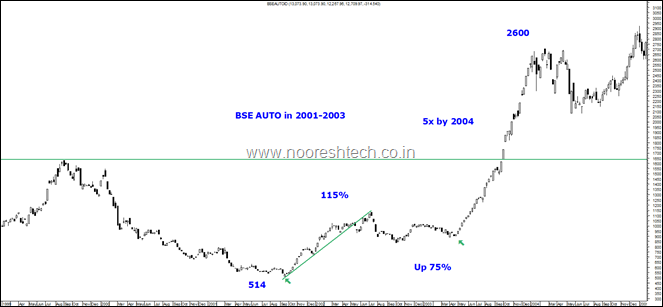

1) Autos

BSE AUTO came 60 -7 0% with the Market but recovered 115% in 2001 -2 002. When Sensex moved from 2600 -2 900 by 2003 this Indicator was up 75% By 2004 it was up 5x from the lows and 60 -6 5% higher from February 2000 pinnacles.

Capital Goods

Down 60 -6 5% from the flower and then recovered 100% from the lows by 2002. Fund Goods were up 80 -9 0% by 2003 freighter for Sensex which was only up 10 -1 2% Crossed the increases of 2000 too and was up 5x from lows and 60 -7 0% from 2000 highs. The Indicator extended up to 21000 by 2007 and up 40 x from 2001 lows and 20 x from 2003 lows.

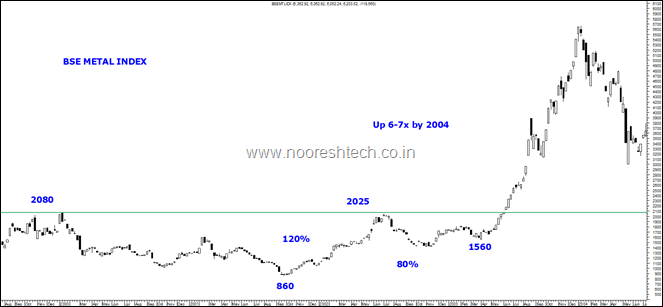

BSE METAL INDEX

Down 55 -6 0% in the fall but recovered 120% and same high-priceds by 2002. Up 80% by 2003 with Sensex only up 12% Up 6-7x by 2004. The Indicator was up 20 x from from 2001 lows and 10 -1 2x from 2003 lows.

Oil and Gas

The index was also up 70 -1 00% in 2001 -2 002 and 2001 -2 003.

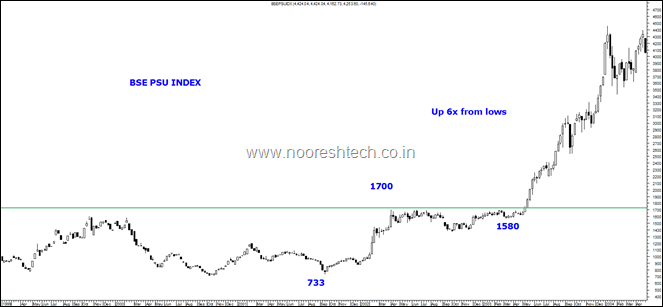

PSU Index

Fell 50 -5 5% in the fall but recovered and originated new high-pitcheds in 2002. Up 100% from the lows by 2003 and 130% up by 2002. It was up 6x from lows of 2001.

FMCG

The sector topped out with Hindustan Unilever and made a new low-pitched in 2003. Could not bridge 2000 highs till 2005 and Hindustan Unilever was a laggard for a decade. Even Pharma started catching up only in 2004

IT SECTOR- Down 90%

Fall and Consolidation of 2008

a) The Fall

The fall was huge as it retraced virtually 75% of the move. But also the revival was huge as well with Indices up 7x from the lows of 2003.

The first fail was of 30% in January 2008 and the final bottom in October 2008.

b) The Consolidation

Lasted simply for 5-6 months from October 27 th to March 2009 with approximately similar tushes on closing basis and 5-10% higher on lows.

c) Stock Behaviour

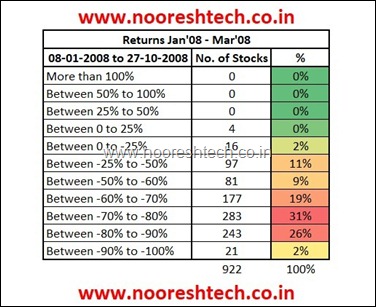

Jan 2008 to October 2008- Brutal

87% of stocks were down more than 50%. 79% of stocks were down more than 60% 60% of stocks were down more than 70%.

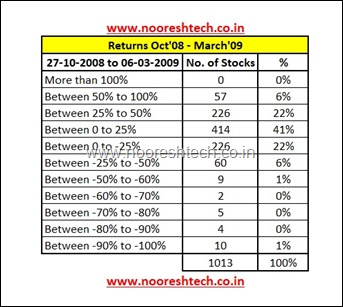

October to March 2009

30% of the stocks stimulated new lows. 28% of the stocks were higher than 25%. 70% of the stocks were higher by the 2nd dip.

Sector Change

Real Estate/ Infra came smacked 70 -9 0 % in 2008 and Capital Goods also has been an underperformer ever since. FMCG, Pharma, Consumers. Home Building Materials, Chemicals, Banks and Financials took head in the next decade.

The Fall of 2020

a) The Fall

In percentage terms the descend perhaps 40% but it has retraced 50% of the is removed from 2008 and 61.8% from the lows of 2010-2011.

b) The combination

The big question is have we prepared the bottom, or the next tush would be a double immerse or we have a few more legs to go. The retracement has been enormous just like previous bear market but its not a 60% dusk like 1992/2000/ 2008. So for the above reasons most bearish expectations are placed at 6400 -8 500 where 6400 is the peak of 2008. But the stock behaviour is very close to the fails of 1992/2000/ 2008. That suggests we are getting into consolidation and may have just one more down leg which might have started from 9900.

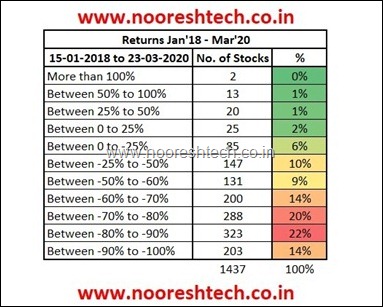

c) Stock Behaviour.

79% of stocks are down more than 50% 70% of stocks are down more than 60% 56% of stocks are down more than 70%

Price damage is almost similar to 2008.

d) Sector

Out of previous sectoral changes what we have seen is some thoughts to catch the next area. New Sectors may have many brand-new registers or business who come out of nowhere or alter. Wipro was not an IT co.

IT and Telecom was a brand-new sphere in the late 1990 s Old Economy were laggards which did well in 2003 -2 007. Real Estate and Infra were new spheres. Pharma and FMCG were laggards of 2002-2010. Chemical were laggards. AgroChemicals a New Sector. NBFCs was a brand-new sector with brand-new reputations. Bajaj Finance was a demerger. some were middlemen before.

Going forward it would be a good time to look at laggards and brand-new areas or even Old Heroes which have survived. Price Action will be an important thing watch along with Sector Reasons,.

Conclusions

We equate current bear market to previous bear markets as equity markets go through cycles and one can find similar action in precede repetitions. For example in 1992/2000/ 2008 the Index fell 55 -6 0 %. The leading areas Cements of 1992 or IT of 2000 or Infra/ Real Estate of 2008 came 70 -9 0% and numerous never came back. Too after a big bear market where 70% of the stocks have come more than 50% like in previous rounds the consolidations last long and then brand-new lead areas develop. Many bear markets coincide with Events- September 2001 terrorist attack, Global Financial Crisis 2008 and Covid1 9 in 2020. A heap changes in the short term, some in medium term and in long term we get back to human nature.( After 2001 a lot of security systems converted, After 2008 everyone was Debt Averse, EMIs and Debt came back in few years, Lockdown has shown us how little we need to live but is that the Life we Want ?) Nifty might have started a bear market in 2020 but the Bullish move of 2018-2020 was very narrow and broader marketplaces are in a bear market since 2018. Price Fall is similar to 2000/2008 for broader groceries. Like in 2000-2003 the Index made a long time to bottom out but a great deal of sectors and assets did gargantuan moves. Some bit of affinity with 2000 -2 003 is possible in broader market action. There is one section of the large cap, large-scale aspect midcaps and strong transactions which are priced to perfection- A spate of FMCG, Paints, some Compounds, some Pharma. some Consumer etc.Lot of herding in many Midcap specifies with MFs own 15% of equity and FIIs own 5-10 %. There is other section of identifies in Smallcaps, Midcaps and many sectors which are priced for Liquidation.( Not only below Replacement cost but below Liquidation Value .) FII comprising in BSE5 00 is back to the lows of December 2013 of 20% and in overall Total Marketplace Cap down to 18 -1 9 %. Previously low-pitched was 16 -1 7 % in 2008 freighters. Over the next few months and times there will be a lot of opportunities due to mispricing but a bigger opportunity when the combination is over. “Its time” even if you do not buy but you need to keep researching impressions, sectors. Some goes a lot of bull market areas start not just because of the greatness of that sector but consolidation and insolvency of a large company in such sectors. There “couldve been” many rationalizations. But after a Bear Market we do read new opportunities “re coming”. Some Lessons

1) Cements were laggards post 1992 but did well in 2003 -2 007.

2) PSU Stocks, Metals, Capital Goods and a great deal of Old Economy capitals “ve done nothing wrong” in 1990 s but went 20 -1 00 x in 2003 -2 007.

3) Pharma and FMCG was supposed to be Defensives. Went 10 x-2 0x in 2010 -2 015 even when Nifty was not doing well.

4) Chemicals were commodity companies and did nothing for 2 decades and now are speciality business.

5) NBFCs more came scheduled and delisted in 1990 s but in the past few decades but did brilliant between 2014 -2 018.

Also in the interim period of Consolidation there could be a lot of possibilities because of severe mispricing and negotiates. Some can be cash bargains, some bargain coz of a barrage auction by societies, Insider Buying, Buybacks. These require a lot of research and conviction. The buying has to be done at times patiently and at times urgently. You may experiment a lot but not catch a good deal, due to uncertainty/ fright but these same specifies researched now will assist in next cycle. I retain buying Garware Wall Ropes at 44 as a bargain with 4 PE and 6% provide, aarti Inds at 6 PE and translation but last-minute in 2014 at 3x-5x higher there were different reasonableness to buy- rise, quality, area tailwinds etc.

What Next- My Thoughts?

Over the next 2-5 years there could be some sectors which could take up leadership due to various concludes. Some experiences new sectors come from New rolls and some times from laggards. Every Bull market one determines mistakes( I have uttered plenty, down 50% from top. Highest drawdown since 2013. ). A Bear market hurts you in various ways apart from the Equity Portfolio. Like today I do not understand what retains me a little worried my PF, Business or Covid1 9. Going forward there could be a lot of Job losses and Business Losing too.( Do read this it are helpful in – https :// www.safalniveshak.com/ you-lost-your-job-now-what /) Its generally said Groceries discount the future and the sharp-worded fall in so many companies is an indication that things is now time actually be tougher for a lot of jobs, businesses and more. A quantity of businesses, Jobs get hit due to absolutely no mistake of theirs. A performing friend lost a job because his Promoter had to shut down the profitable company due to lack of funds caused by a big hit in another business. Receivables and Bad Debt of private individuals/ companionship can affect other professions. Tourism, Aviation, Hospitality, Oil associated and so many other sectors will get hit.( Some of my keeps have been flogged .). A taken into consideration autobiography tell me something- Nothing Lasts Forever. I is definitely not old-time enough to have seen previous cycles/seconds but some things which I remember about how you get hurt in various cycles and recovery.opportunity likewise comes from unexpected behaviors.

A big flashback

Made money doing Advertisings for Dot Com Company and Marketing Surveys for Brands in 2000 -2 001. By 2002 when I assembled engineering there were hardly any placements. We had previous year postgraduates as our Teachers due to lack of opportunities. I used to earn more than 50% of an Designer pay giving Private Tuitions for a couple of hours daily. By 2005 majority decisions of our batch was arranged with employment opportunities in 3rd time of Engineering and the upshot of 5 semesters. Was on Bench for 90% of my 6 months IT Job in 2006.2007 was a super bull year and business did well for us. By 2008 -2 009 Engineering Grads and MBAs had a tough time getting a task and even Job renders came delayed.Friends in US had to do quirky chores after Masters for some time. A bunch of beings got laid off in 2008 -2 009 but luckily it should not been a long time. Portfolio got hit, Business stumbled and some money stuck in a Co-Op Bank which got taken over by a PSU Bank. 2011 -2 013 some layoffs happed in Equity Broking Cos. The entire prototype of Sub Broking came shattered who were a big place of our consumers. Started a go in Broking and closed in 6 months. By 2013 Portfolio, Business got hit. 2014 -2 017 was prospering for many manufactures peculiarly Equity. Since 2018 its been tough for beings like me in Equities and berth Covid1 9 is going to be tough for a lot of Businesses.

The worst road to deal with such a crisis is to compare your current state with what you had. For example a portfolio down 50 -6 0%, A compensate chipped, Dwindling Business will get compared to the Peak of last couple of years- Portolio Peak, Appraisal/ Bonus, Super Profit. The other method to look would be what do you have now and how long are you able survive on it. In that survival date one needs to grind out, hustle, re-skill etc. Also in such intervals one can definitely increase Work-Life Balance. A batch of parties will show how one needs to be positive and numerous things. The detail is one is bound to be worried with so much better happening around. Concerned about but not Chilled !! Keep faith and self-belief. Another mode to deal with it is to focus on your hobbies and family. So find ways to spend your time which gives you emotional gaiety.( This period has been tougher for me as in earlier cycles would frisk a lot of athletics. Now playing with twin sons is fun but persisted at home .). The Consolidation periods are lengthy and tiring. A lot of excitements at performance everyday. Patience will get researched. History likewise proves – Post such seasons there comes a period of super opportunities. These opportunities give you fairly chances to recover way beyond your mistakes. “Its time” where a good deal of hard work will go into researching, reskilling, learn, learning and so many other things but no gratification or outcomes in near word. But eventually it is these periods which decide how you will be able to do better in coming years. Focus on what you have and what you can do over the next numerous months in numerous facets of life and not just Financials, Job, Business. Time not lose faith, self- belief and integrity. Stop over-thinking. Keep it simple. Best Wishes to Everyone.

Suggestions for Me.

Personally have found it difficult to do any long the curricula of consolidations.( bot CFA notebooks in 2007, Enrolled for CFP in 2009, Small Courses on Finance through 2011 -2 018 and met a lot of people .) So would enjoy if you think any route/ journal/ podcast which is helpful in me learn- Please mail to nooreshtech @analyseindia. com From our slope we are trying to create content for hear for blog readers.

Youtube Channel& Posts( Please mail for topics you would like us to cover)

My first youtube video was in 2008 and Webinar in 2009. Have been intermittently construction some in between. Me and my crew mate Harsh Doshi will be determining few videos over next countless months for self-learning as well as for others. Some videos already constituted.

Some videos realise.

1) How to Track Market Using Google Sheets

2) How to Analyse Delivery Volumes

3) Relative Strength How to Identiy Relative Outperformers

4) How to Track Market Using Google Sheets

Please mail us interesting topics you would like us to cover.

Online Technical Analysis Course( Fees Rs 6000 )

Finally appointed an Online Course which has 10 -1 2 hours of Video Content. May included more also on suggestions.

Read more: nooreshtech.co.in