California just dropped a bombshell that has billionaires scrambling… except one. A proposed ballot measure could hit the state’s ultra-rich with a one-time 5% tax on net worth exceeding $1 billion for those living there as of January 1, 2026.

We’re talking potential $100 billion in revenue over five years, funneled straight to healthcare, education, and food assistance programs.

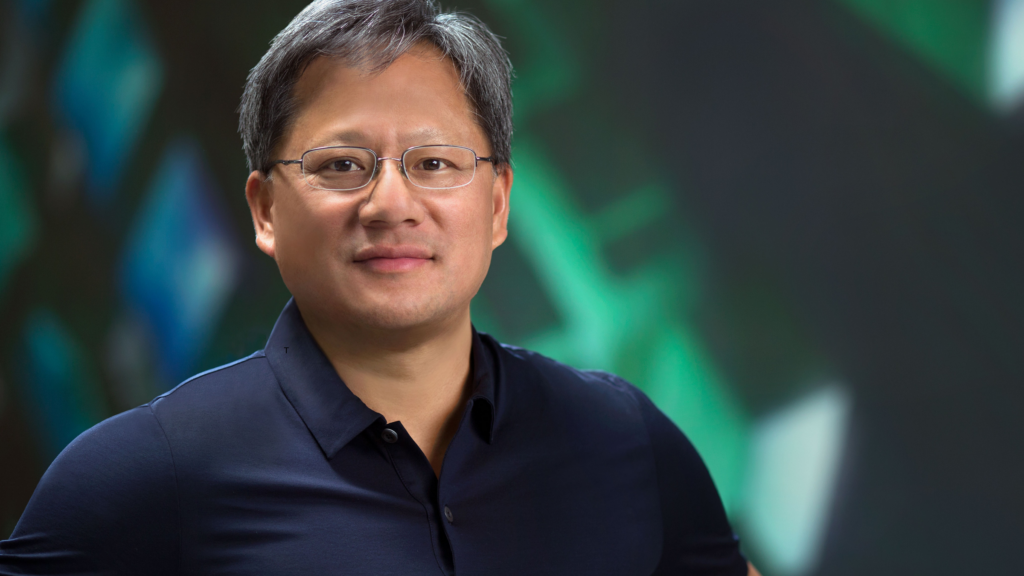

But while some tech titans are quietly packing up, Nvidia CEO Jensen Huang? He’s chilling. With his net worth soaring into the hundreds of billions, this could mean an $8 billion hit for him alone. Yet Huang’s response? Total calm.

What’s his secret, and why isn’t he panicking like the rest?

What the Proposed Billionaire Tax Means for California and Its Wealthiest Residents

The California billionaire tax proposal would apply a one-time 5 percent levy on the net worth of individuals with assets exceeding $1 billion who live in the state as of January 1, 2026.

The measure, backed by the Service Employees International Union-United Healthcare Workers West, still needs to collect more than 870,000 signatures to qualify for the November ballot.

If it makes it onto the ballot and voters approve it, about 200 California billionaires could see significant tax bills. Real estate would be exempt since it is already subject to property tax. Stocks, business holdings, and other qualifying assets would count toward the wealth total.

Supporters argue the revenue is critical to plug budget gaps in public services, especially as federal funding cuts strain programs like Medicaid.

This kind of wealth tax has never been enacted at the state level in the United States, making it an unprecedented test case. Opponents warn it could prompt capital flight, deter investment, and weaken California’s innovation ecosystem if wealthy residents and major companies choose to relocate.

Why Jensen Huang Shows Little Concern About an $8 Billion Tax Bill

When Bloomberg Television asked Nvidia CEO Jensen Huang about the potential tax, his reaction was strikingly relaxed.

He said he had not “even thought about it once” and that he and his company chose to live in Silicon Valley because of the deep talent pool there. “Whatever taxes they would like to apply, so be it,” Huang said. He added that he was “perfectly fine” with the proposal.

Huang’s comments stand in sharp contrast to the reactions of many other high-profile tech leaders. Some, like Google cofounder Larry Page, have moved business interests out of California.

Others, such as Peter Thiel, have opened new offices elsewhere, including in Miami. Those moves reflect concerns that a wealth tax could make California less attractive for wealthy individuals and their companies.

In Huang’s case, his willingness to stay appears rooted in a long history with the region. Nvidia was founded in California more than 30 years ago and has grown into one of the most valuable companies in the world by building the chips that power modern AI.

Staying close to Silicon Valley’s research institutions, startup culture, and engineering talent has been central to that growth.

Huang’s net worth is largely tied to his stake in Nvidia. Forbes and Bloomberg Billionaires Index estimates put his wealth well into the hundreds of billions. If the tax were enacted, his bill could be in the ballpark of $7.75 billion to $8.2 billion. But Huang’s reaction suggests he views that as a cost of living and working where innovation happens.

The Broader Debate: Talent, Taxes, and Tech Leadership

Huang’s stance has opened up a bigger conversation about what motivates wealthy executives and entrepreneurs.

For some, tax concerns are closely tied to decisions about where to live and operate. Others see strong public services and social infrastructure as complementary to a thriving tech ecosystem. Experts in economic policy say the differing reactions among billionaire business leaders may reflect personal attitudes toward risk and uncertainty, not just financial calculations.

Some wealthy individuals choose to rearrange their affairs to minimize potential tax impact. Others see the benefits of remaining where their teams and operations are already rooted For California, the stakes are high either way. If the ballot measure qualifies and passes, it could reshape state tax policy and how the ultra-wealthy engage with local economies.

If it fails to reach the ballot or voters reject it, California will still face ongoing budget challenges and debates around funding essential services without alienating major taxpayers.

What do you think? Would a wealth tax drive innovators away from a state, or is it a fair way to address budget shortfalls and inequality?