The Amount Of Money Needed To Retire Early And Live In Abject Poverty

As more people look to retire early, more people are looking for shortcuts in order to get to early retirement quicker.

It’s understandable that in this day and age of instant gratification, young kinfolks nowadays aren’t willing to grind it out for decades like previous generations.

Instead of house a large enough passive income portfolio to cover a comfy life, I’ve noticed more parties are willing to retire early to live in or near poverty!

I can empathize.

When I was 25, the 9/11 terrorist attack happened. This terrible event erupted my quarter-life crisis. I seriously thought about retiring with ~$ 400,000 and moving to Hawaii to become a fruit farmer on my grandparents’ under-maintained farm.

In exchange for clearing brushing, watering trees, and doing general upkeep on the house, I could live for free and move some additional income selling mangos, papayas, and pomelos down wall street.

Then I slammed myself silly and told myself to buck up. Throwing apart a perfectly good career in commerce so young was incredibly stupid. So I gutted it out for another 10 years until my investments could generate about $80,000 a year and window-dressing my wanted living expenses in San Francisco.

Defining Poverty By Household Size

Back in 2001, my $400,000 could have generated about $20,000- $24,000 a year in risk-free income. If I sold $10,000 worth of mangos a year, I could have led a relatively comfortable life in Hawaii given I didn’t have dependents or tariff to pay.

Although having a nice tan and washboard abs would be nice due to surfing every day, I demanded more. I wanted to one day to take care of my girlfriend and maybe even start a family.

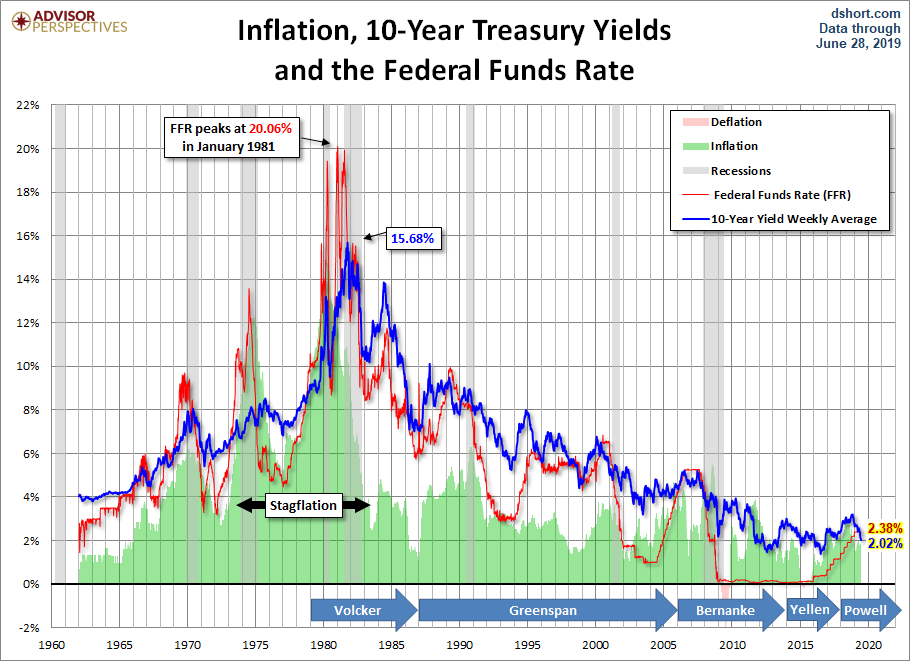

Today, that $400,000 would only generate about $ 8,000- $9,000 a year risk-free given the 10 -year bond yield has precipitated from 5.5% down to~ 2 %. Therefore, there’s no way $ 400,000 is nearly enough for a single person to live on today unless they want to live in a cave or move to a developing country.

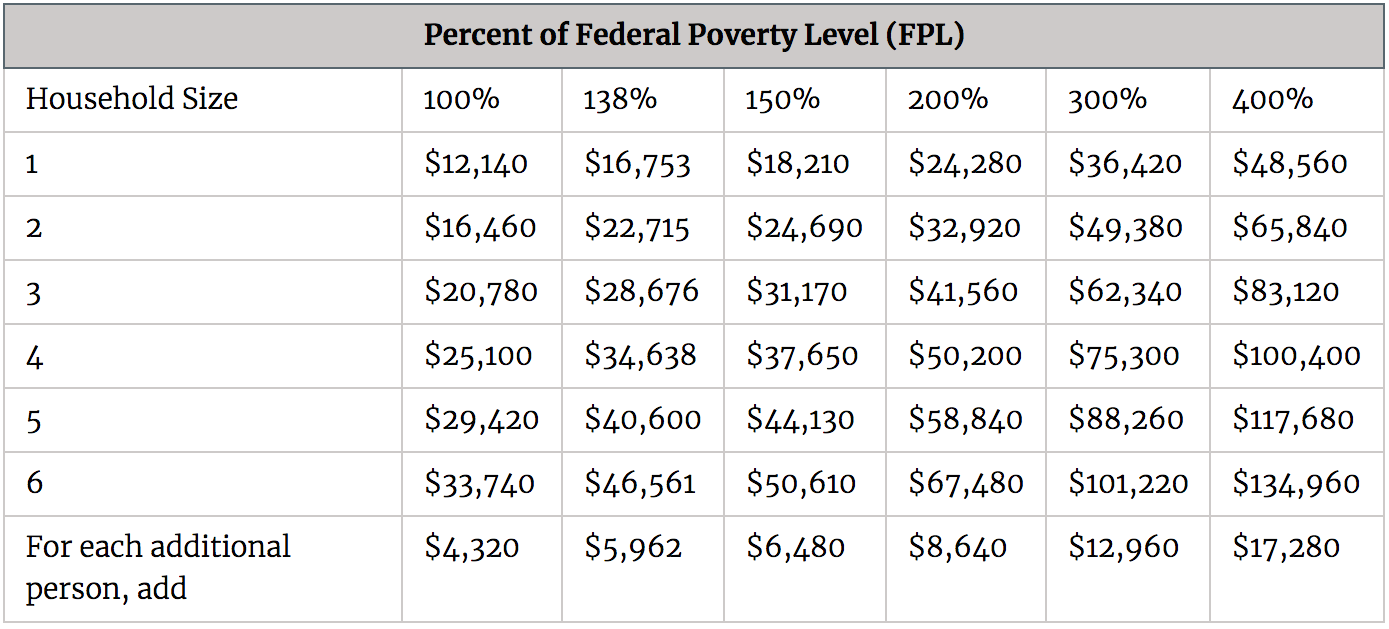

Let’s look at the official Federal Poverty Level( FPL) in the chart below. The baseline federal poverty level is under the 100% piece.

If you prepare $12,140 or less as a single person, you are living in poverty in America. If your family of four builds $25,100 a year or less, your family is also lives in poverty.

The federal government supports healthcare subsidies for households who make up to 400% of the baseline federal poverty level. In other names, if you make 400% or less of the baseline federal poverty level, you are considered poor enough to receive federal succour.

The household income levels between 300% to 400% of FPL seem comfortable as long as the household doesn’t live in an expensive coastal metropolitan like New York or Los Angeles.

For example, I have to imagine a marry with two adolescents concluding between $75,300 and $100,400 is going to be able to live a nice life in the heartland of America where I’ve been investing in real estate properties.

Just recently, the University of Texas, Austin announced families deserving less than $65,000 has not been able to have to pay tuition starting in 2020. Meanwhile, kinfolks performing up to $ 125,000 would also receive some type of tuition subsidy. Hooray! Let’s hope this trend spreads across the country.

However, I’m not here to indicate which household income levels should receive extra assistance from the government. The government, with all its data and knowledge, is the decider of who is poor and who needs help.

I’m here to highlight how big of a retirement portfolio you need to retire early in order to live in or near poverty, which national governments and I define as between 100%- 200% of FPL.

Any household income under 200% of FPL seems actually tight , no matter where you live in America. I’m confident all of you agree.

How Much You Need To Retire To Live In Poverty

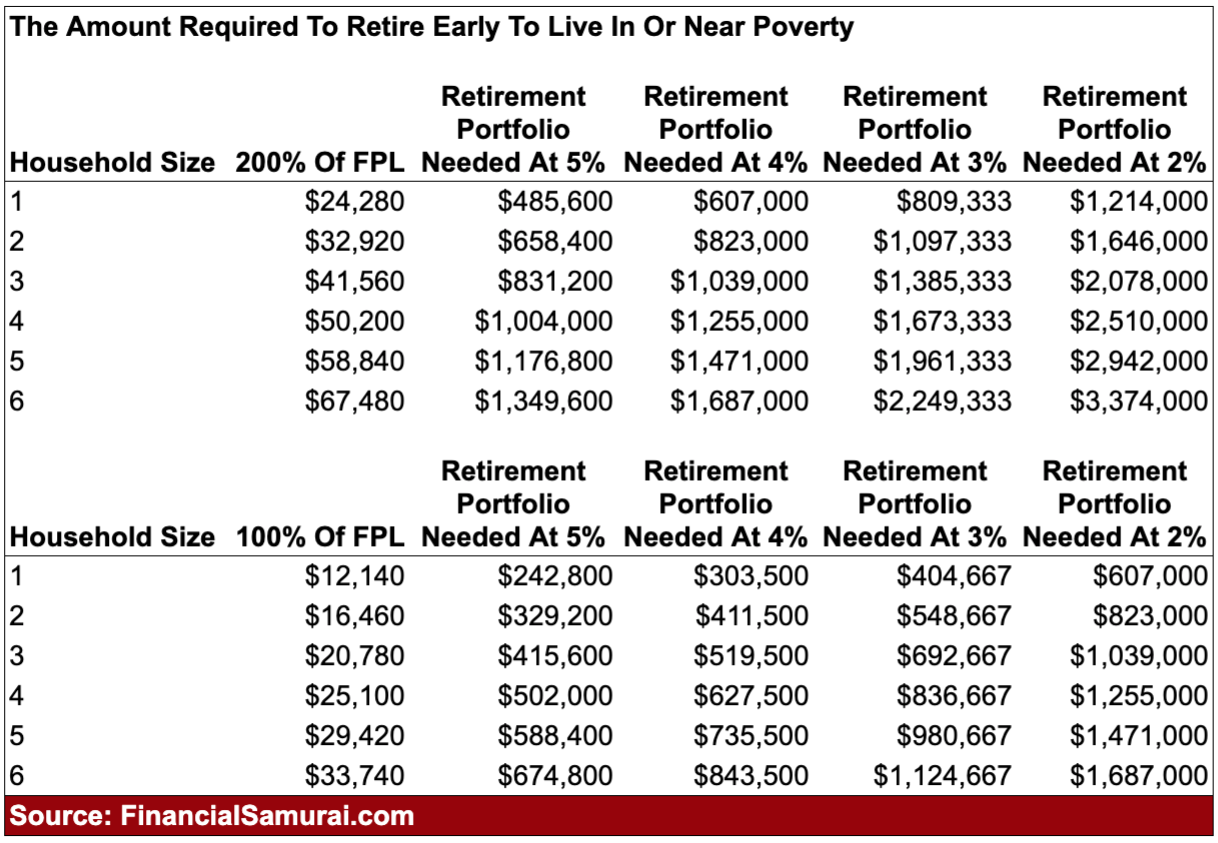

Below is a chart I developed in partnership that shows how large-scale of an after-tax retirement portfolio you are required to by household width and percentage return if your household income is 100% and 200% of FPL.

In order to retire early and live on a household income equal to 200% of FPL and a conservative 2% frequency of return or withdrawal proportion, you will need to amass $1,214, 000 as an individual and up to $ 3,374, 000 for urban households of six.

If you are OK with living in abject poverty( 100% of FPL) and expect a conservative 2% rate of return or withdrawal proportion, then you will only need to amass $607,000 as an individual and up to $ 1,687, 000 for urban households of six.

If a duo wants to have two children and earn up to 200% of FPL in early retirement, they need to amass between $1,004, 000 to $2,510, 000 in their after-tax portfolio based on a 5% to 2% withdrawal proportion and so forth.

Given the 10 -year bond yield is at~ 2 %, I wouldn’t withdraw or expect a return of more than 4% from your after-tax retirement portfolio if you want to stay retired. A 3% withdrawal proportion or expected rate of return is a more responsible percentage.

Personally, I like to match my withdrawal rate to the risk-free rate of return so I never run out of money. Once you achieve financial independence, you never want to go back to the salt mines.

As an early retiree, you best hope interest rates don’t go down far out of range. Otherwise, most households will need multi-million dollar portfolios , not just million dollar portfolios, in order to retire early and live in or near poverty.

Is It Worth Living In Poverty To Retire Early?

For the first 13 years of “peoples lives”, I grew up in developing countries like Zambia and Malaysia where I was surrounded by poverty. Some of my best friends in Kuala Lumpur would share one room and a bathroom with three other family members.

Seeing so much poverty for so many years cleared me focus on school because I “re afraid” becoming poor. When I came to America in 1991, I decided to stop to take my good fortune for granted.

Even though fund doesn’t buy gaiety, fund has to at least cover all our basic living expenses before we can really believes in such an doctrine. I personally would not be willing to retire early if I had to live in or near poverty.

Although my work was traumatic, it enabled my bride and me to own a comfy home in San Francisco, make 5-6 weeks of trip a year, drive a safe vehicle, and develop a family.

For the now three of us to live off simply $41,560 a year( 200% of FPL) would require us to leave San Francisco and start living with my mothers in Hawaii to save on tariff. Although spate of readers have stated they have no problem living at home with their parents as adults, we do.

Our mothers quality their privacy. We’re all set in our behaviors. Living together for an extended period of time would be difficult.

One alternative to living a more cozy early retirement is having a higher withdrawal rate. But this is very difficult to do for us because we’ve been in the habit of aggressively saving and expending for so many years.

The other alternative, which is something that I feel most early retirees do nowadays is freelance or take on curious undertakings to make up for the earnings shortfall. Where things can get hairy is when the early retiree spends endless hours were seeking to perform extra income because their investment portfolios are too small.

They’ve essentially sold one task for another.

Although we’ve lived alone off increased investment since 2012, I’ve been accused of not really being an early retiree because of the size of Financial Samurai. That’s totally understandable, which is why since 2013, I haven’t told anybody in real life that I’m an early retiree. I just tell them that I’m a writer or a high school tennis coach.

But isn’t it funny that if Financial Samurai was much smaller, I’d get more approval from the Internet Retirement Police? The reading is to never stick out because a hammer will try to bang you down. In real world, you should be as stealth wealth as possible.

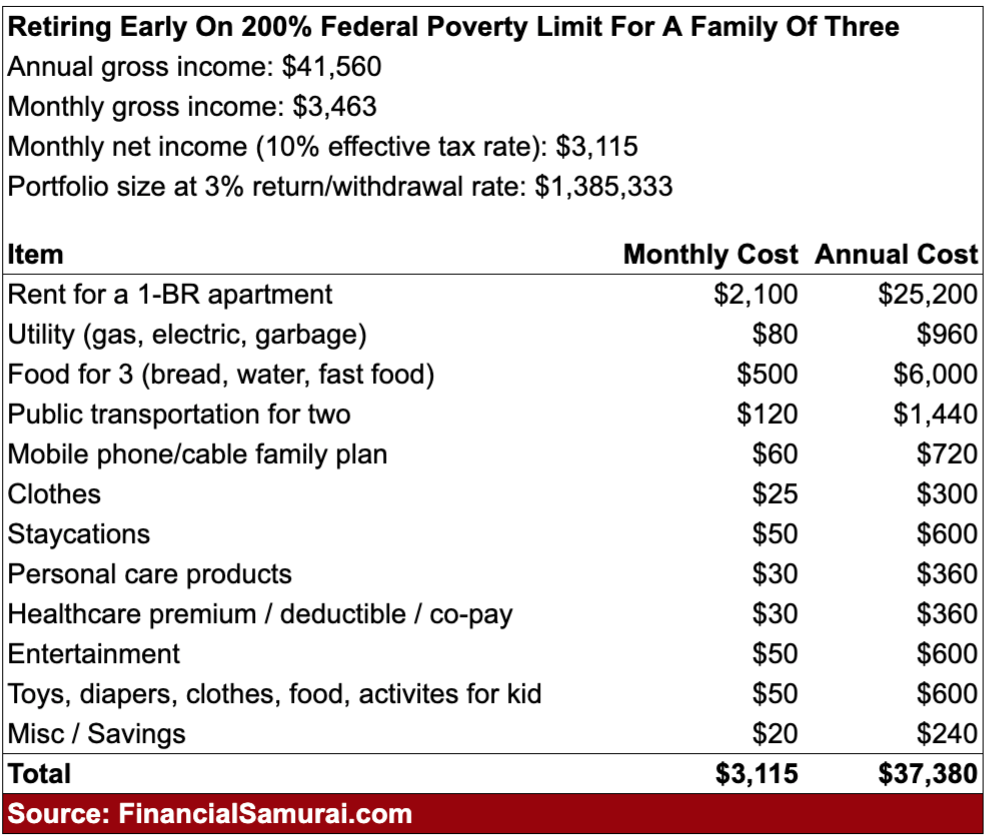

Here’s what I thoughts our budget would look like if our household of three lived off 200% of FPL in early retirement. There is no way we could only live off $ 20,780, or 100% of FPL.

Looking at this 200% of FPL budget realise me a little angry because I miss better for my partner and son. I’d like at least a two bedroom apartment, which would expenditure us closer to $3,000/ month for an apartment 45 minutes away from downtown SF. I’d also want to spend about $500/ month more for meat, $50/ month more on my lad, and $100/ month more on travel.

After going through this exercise, I’ve concluded that my family of three would need to earn at least 300% of FPL ($ 62,340) in early retirement to feel reasonably comfy. At a 3% safe withdrawal rate, we’d, therefore, need a portfolio of at least $ 2,078, 000.

Be Patient With Early Retirement

Instead of rushing to retire as soon as possible, go through the numbers and see if everything manufactures impression. To give up a well-paying job in a bull market to live like a pauper is probably not ideal.

One of my early retirement regrets is retiring too soon. I would have been financially better off if I had accumulated various more years of income. It’s only after you’ve permanently left the workforce for a while that you realise how truly long post-work life is.

For those people willing to live in or near poverty to retire early, I say more strength to you. Living a simple life without much passion or wealths is the key to enlightenment according to the Buddha. Just know that there’s a chance your overheads will increase as you age. Worst case, you can always just go back to work.

The math actually doesn’t lie , no matter how our emotions stir us feel. At the end of the working day, it’s up to each of you to figure out what works best for you and your family.

Note: There is a poll embedded within this post, please visit the site to participate in this post’s poll.

Related:

Living Paycheck To Paycheck Off A$ 5 Million Retirement Portfolio

In Search Of FIRE: Fiscal Samurai Retirement Portfolio Review

Readers, would you be willing to retire early to live in or near poverty? Why or why not? What is the lowest FPL level you’d be willing to accept to retire early? How much money are you trying to accumulate to retire early? Do you think young tribes retiring with the amounts in my planned are making a mistake?

Note: If you are an RSS reader, we’re moving away from Feedburner b/ c Google no longer patronages it. I propose working Feedly for an RSS book instead. Here is the URL to our feed: https :// www.financialsamurai.com/ feed

The post The Amount Of Money Needed To Retire Early And Live In Abject Poverty showed first on Financial Samurai.

Read more: financialsamurai.com