How to calculate your debt to asset ratio (+ examine if it’s good)

Here’s what debt to asset rate intends 😛 TAGEND

When you’re a business( i.e. you have your own business or side hustle ), your debt to asset ratio represents the total amount of indebtednes you owe compared to your total amount of assets.

This measures how much lenders will be willing to give you AND helps you be aware of how much you owe to creditors.

If you’re an individual, its external debt to asset rate won’t be as relevant to you…but your debt to INCOME ratio will be. That’s the number representing the total amount of pay you owe compared against your income.

Mortgage lenders, bank loan, and anyone giving you credit will take a look at your indebtednes to asset/ income ratio in order to determine how much they’re willing to be provided to you.

Your debt to asset rate( or obligation to income fraction) could want the difference between securing a credit for your business or home, and not get a single dime from a lender.

To help you get a better understanding of it, let’s break down what pay to asset fraction might look like in real life.

Explain Like I’m 5: Debt to asset fraction

Let’s say an unemployed acquaintance of yours, we’ll call him Jeff, asks to borrow $10 from you.

What do you do?

Immediately, with your $10 in your hand, you’ll ask yourself a assortment of questions about Jeff, including 😛 TAGEND

“Do I trust Jeff? ” “Will Jeff paid in full back? ” “Whoa, why is the person from Hamilton on the $10? ”

Hard to answer these questions, right? Now profess a third party, your reciprocal friend Mary, tells you that Jeff borrowed $100 from her last week and hasn’t paid it back. Now what do you do?

You slip your $10 back in your pocket and move on.

In a nutshell, this is debt to asset ratio.

However, that’s not the only debt ratio you need to understand. In IWT fashion, we’re going to give you the rundown on three obligation ratios that are going to matter the most to you, your life, and/ or your business. They are 😛 TAGEND

Debt to asset rate Debt to equity fraction Debt to income rate

It’s so important to keep these counts in brain to be aware of your indebtednes( if you have any that is ), because when they’re out of whack they can stifle your ability to form some large-hearted purchases.

Obligation to asset fraction: Important for businesses

( NOTE: If you’re not a small business owner or don’t run your own side hustle, you can skip down to debt to income fraction .)

Like your approval score, your indebtednes to asset fraction is a number. One that goes to show how much of your resources — concepts like your currency, assets, inventory, etc. — were paid with obligation, including 😛 TAGEND

Credit posters Bank loans Student loans Mortgages

( Pretty much any speciman that you owe coin to someone .)

The way you calculate your pay to asset fraction is simple: Take the amount of obligation you owe and divide it by the value of the assets you own. Then, make that crowd and multiply it by 100 so you get a percentage. That’s your indebtednes to asset ratio.

It’ll look something like this:

Dollar amount of indebtednes you owe/ Dollar amount of resources you own= Debt to asset ratio

And then 😛 TAGEND

Debt to asset fraction x 100= Debt to asset rate percentage

It’s actually that simple.

What is a good debt to asset rate?

The higher your pay to asset rate is, the more you owe and the more risk you run by opening up brand-new strands of credit.

According to Michigan State University professor Adam Kantrovich, any ratio higher than 30%( or. 3) may lower the “borrowing capacity” for your business. That’s why it’s so smart-alecky for you — extremely if you’re a business owner or freelance — to know your pay to asset ratio.

However, the amount your indebtednes to asset ratio affects your business will motley from industry to industry.

For example, ventures that render internet services generally don’t require a lot of debt up front to start. That means they’ll generally have lower debt to asset fractions on average.

However, industries such as production or retail require a LOT of pay up front in order to get started. As a solution, it’s not uncommon to see higher debt to asset fractions among them.

Check out the chart below to find out the average debt to asset rate in a few different industries.

Industry Average pay to asset rate

Internet services and social media 25% Consumer electronics 34% Energy 108% Technology 110% Utilities 228% Retail 289%

From CSI Market( a market analysis formation)

“Holy crap, Ramit! Why are businesses like utilities and retail so high-pitched? ”

Businesses like practicalities and retail require a whole lot of initial asset up front to cover initial costs of things they need to run their business( infrastructure, produces, manpower, etc .). As such, the average debt to asset fraction for those working industries will be higher.

Many lenders such as banks and mortgage business may take this into consideration when they’re lending to you and your business.

Say you’re a small business owner looking to get a brand-new credit for your gues. After totaling everything up, you find that you owe about $25,000 in debt and own about $100,000 in assets.

After dividing your debt by your assets and multiplying that number by 100, you was revealed that your obligation fraction is 25% — which is just about the average if you work in internet services and stellar if you work in retail.

However, if those crowds were turned( you owe $100,000 in debt and own simply $25,000 in assets ), your obligation to asset numeral “wouldve been” 400% — which is just awful no matter what your business does.

A tone on debt to equity ratio

Sometimes, lenders will look at a business’s debt to equity rate instead. Occasions are this doesn’t apply to 99.999% of you. But so you know, indebtednes to equity looks at a company’s debt compared to shareholder equity( the value of the shares) and is calculated the same way as debt to asset fraction 😛 TAGEND

Dollar amount of indebtednes you owe/ Dollar amount of stockholder equity= Debt to equity ratio

And then 😛 TAGEND

Debt to equity rate x 100= Debt to equity ratio percentage

Like debt to asset fraction, your obligation to equity fraction will diversify from business to business.

However, general consensus for most manufactures is that it should be no higher than 2( or 200% ).

“But Ramit, I don’t have a big company or business. Does any of this matter to me? ”

Yes! Because there’s a formula that both creditors and lenders use to assess the risk of individuals like you.

Debt to income rate: Important for individuals

If you plan on ever getting a mortgage for a live, you need to make sure your debt to income fraction is in check.

This number compares your gross monthly income to your monthly debt. Banks and other lenders look at this numeral to determine how much of a risk you are to lend to. The more of a risk you are, the less of a chance they’ll lend to you at all.

Much like your debt to asset fraction, calculating it is simple 😛 TAGEND

Dollar amount of monthly indebtednes you owe/ Dollar amount of your gross monthly income= Debt to income ratio

And then 😛 TAGEND

Debt to income rate x 100= Debt to income rate percentage

Let’s run an example scenario 😛 TAGEND

Say you owe about $1,000 in debt month-to-month and start $75,000 a year ($ 6,250/ month ). We’d then make 1,000 divided by 6,250 in order to get our pay to income rate, like so 😛 TAGEND

1, 000/ 6,250=. 16

Multiply. 16 by 100 and you have 16% for your debt to income ratio….but what does that digit imply?

What is a good debt to income fraction?

The lower the number is, the better. According to Wells Fargo, the ideal debt to income rate is 35% and below. That said, most lenders will provide you a lend up to 43 -4 5 %.

So if your obligation to income rate was tantamount to 16% like in the precedent above, you’d be in good shape for a home loan.

If your obligation to income rate is a little higher and you want to lower it, though, I’d like to help you out.

After all, being in debt is the# 1 obstruction to living a Rich Life, and not only is it a monetary headache, but it can also be a HUGE mental load as well.

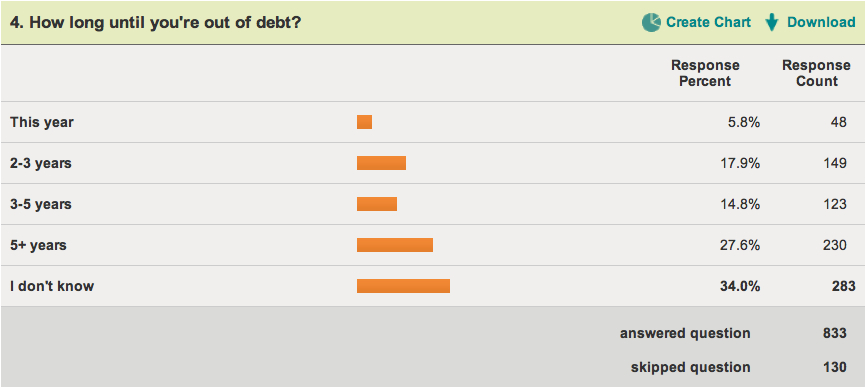

For example, a while back I raced a cross-examine of my readers who were in debt, expecting them a apparently simple question: How long until you’re out of debt?

Take a look at the results 😛 TAGEND

34%( the majority of members) of respondents DIDN’T KNOW how long it would make until they were out of debt.

Debt is just as much of an feeling topic as a fiscal one. That’s why throwing a personal finance book at person in debt or proving them a indebtednes calculator creates little to no change.

If someone’s too afraid to even open the envelopes that will tell them how much they owe, “information” is not what they need. Instead, that person has to be willing to take action THEMSELVES before anything will change.

If you’re reading this now, and you’re ready to take action against your debt, I want to help you.

In fact, you can start getting out of debt TODAY through a 5-step organization I’ve developed.

Just check out my popular section on how to get out of debt now.

Come out of debt and live a Rich Life

So that’s your debt to asset rate. It’s a good way to keep an eye on your personal business and an element to consider if you want to get a loan.

But eliminating debt is just the first step on the travel to living a Rich Life.

If you want to learn my best approaches for creating multiple income series, starting a business, and rising your income by thousands of dollars a year, download a free imitate of my Ultimate Guide to Making Money below.

Just enter your name and email below to get instant access to the Ultimate Guide to Making Money.

How to calculate your indebtednes to asset ratio (+ check if it’s good ) is a post from: I Will Teach You To Be Rich.

Read more: iwillteachyoutoberich.com